London: Prime central property has worst half-year performance since 2009 as asking prices cut

Prime central London property registered its worst half-year performance in more than seven years as sellers drop asking prices to entice buyers. That is according to the Prime Central London Sales Index for February 2016, published by the estate agent Knight Frank.

In the six months to February, prime prices dipped 0.6% on average, the weakest reading since June 2009 amid the financial crisis. Knight Frank also said prime asking prices were being clipped by between 5% and 10% so buyers feel they are getting value for money. Price growth has been rapid over the past few years as overseas investors flooded the market because of London property's reputation as a "safe haven" asset.

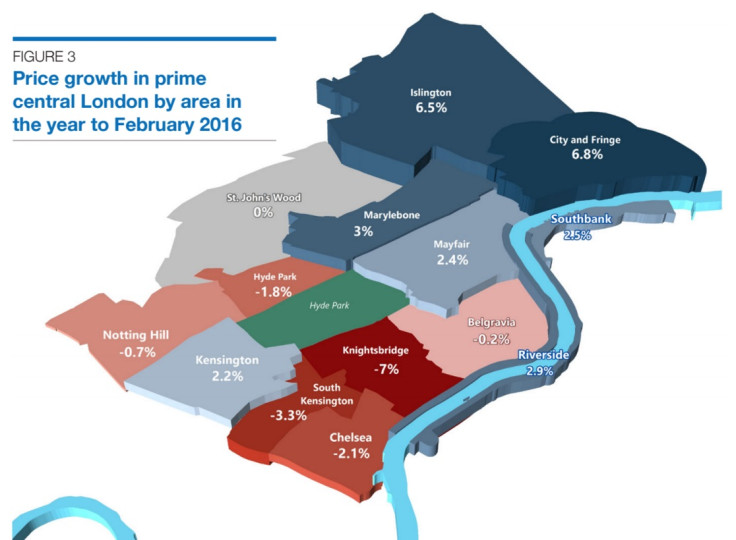

Month-on-month, prime London prices dipped by 0.1%, slowing annual price growth to 1%. Fast price growth in Islington (6.5%) and City and Fringe areas (6.8%) offset sharp declines in Knightsbridge (-7%) and South Kensington (-3.3%). Prime London buyers have in recent years looked beyond traditional areas in the west end to outer boroughs in search of value.

"A combination of higher levels of stamp duty and volatility in global financial markets means demand for prime central London property has been subdued in the first two months of 2016," said Tom Bill, Knight Frank's head of London residential research.

"In particular, the start of the year has been overshadowed by fears surrounding the impotence of central banks. Indeed, the prospect of negative interest rates triggered a fall in the share price of European banks and spread uncertainty in markets already digesting low oil prices and a Chinese economic slowdown. Buyers have adopted a wait-and-see approach as the negative headlines in the business pages combine with domestic political uncertainty in the shape of a London Mayoral election in May and an EU referendum in June."

© Copyright IBTimes 2025. All rights reserved.