Mis-Selling Derivatives Scandal: Banks Speed Up Review Process on FCA Pressure

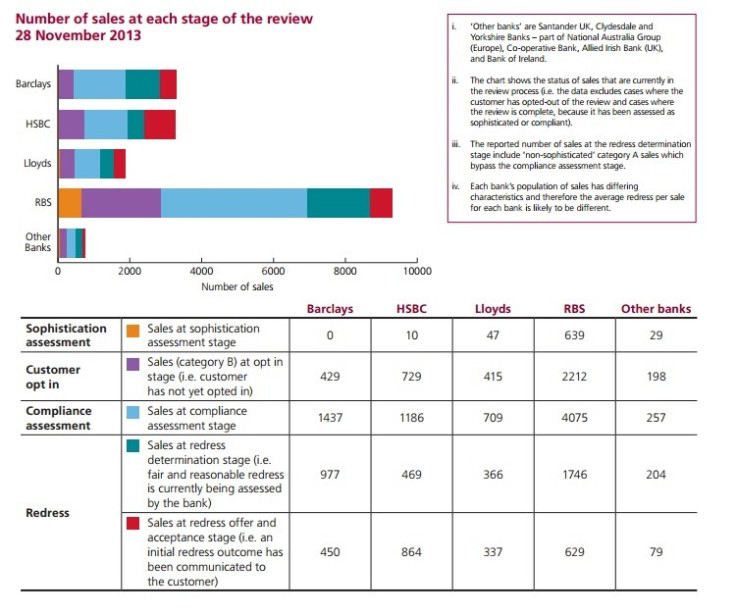

The Financial Conduct Authority has revealed that Britain's biggest banks are speeding up the process for reviewing alleged victims of mis-sold interest rate swap agreements after writing to the groups' chief executives last month.

According to the regulator's latest published findings over the IRSA scandal, banks have started to install new procedures to deliver faster determinations on whether customers have been mis-sold a swap and, if so, what level of redress should be made.

"We reported last month that we had written to the chief executives of the four major banks to re-assert our expectation that redress should be delivered to customers quickly and to agree practical ways to speed up the process," said the FCA in a statement.

"The banks responses have been positive. They have agreed to publish projections for completion of their reviews, giving customers full visibility of their delivery plans.

"The banks are also implementing initiatives to speed up the process. For example, some banks will start sending out lower risk redress offers to customers (i.e. where the customer is being offered a full refund of payments) before they have been checked by the independent reviewer. The cases will still be checked by the independent reviewer, but the change in process will speed up the payment of redress to customers."

Interest rate swap agreements are contracts between banks and customers where typically one side pays a floating or variable rate of interest and receives a fixed rate of interest payments in exchange.

Such contracts are used to hedge against extreme movements in market interest rates over a given period. Companies that saw the value of these products move against them as rates fell during the recession now owe banks inordinate sums of money in yearly interest payments.

FCA's Frustration

Last month, the FCA vented its frustration over the banking sector's slow progress in reviewing interest rate hedging products, as data shows 95% of sales were non-compliant.

The overall rate of non-compliant sales stood at 95% but only £15.3m (€18.3m, $24.8m) has been paid in redress to customers, according to the FCA's review data for October.

"Progress to this point has been slower than expected, but the latest figures show a significant pick up from earlier publications. We have written to the banks to make our expectations clear and agree practical ways to speed up the process," said the FCA in a statement.

The Review and Pilot Scheme

At the end of January this year, the FCA unveiled its findings from a pilot scheme that examined the sale of 173 IRSAs to British firms. It found that at least 90% of those did not comply with at least one or more regulatory requirements.

Nearing the end of 2013, FCA data shows that non-compliant sales are still around the same level.

While some 40,000 IRSAs sold to UK businesses are said to be eligible for review, the pilot scheme was aimed at assessing a select number of cases in order to test the range of disputes and assess the scale of redress owed to customers who were mis-sold these complex derivatives.

"The FCA gave the banks six to twelve months to complete their reviews from the start of the process (May 2013) and are frustrated that they are all expecting to meet the lower end of the FCA expectations," said the regulator in a statement.

"The FCA expectation has been that the majority of customers who come under the scope of the review will have been informed of their compliance assessments and, if applicable, will have received an initial basic redress offer by the end of the year.

"Additionally, the FCA expectation has been that the whole process will have been completed within 12 months of starting."

What the Banks Say

HSBC: "As today's published figures indicate, our Past Business Review is progressing well, and we are doing everything we can to complete it as quickly as possible, providing a fair and reasonable outcome to these customers.

Our recent decision to introduce 'split payments' is speeding up the process and means customers get redress that is due to them at the earliest opportunity, potentially months earlier than under the process for a single payment. We are continuing to build momentum, and we have plans in place to meet the FCA deadlines."

Lloyds: "Today's Financial Conduct Authority's report into participating banks' review of Interest Rate Hedging Products shows Lloyds Banking Group is continuing to make good progress with its review. The momentum witnessed in recent months has been maintained during November, with a quarter of opted-in sales now provided with a redress outcome statement. The number of sales at the redress outcome stage has more than doubled during the month.

The Group remains on schedule to communicate redress outcomes to customers within the 12 month timeline set by the FCA, having commenced the review in May this year."

Barclays: "It is in Barclays' interests as well as our customers to complete this complex review as fast as possible and our 600 dedicated staff are working hard to achieve this. Where we have made mistakes, we will put them right."

RBS: "We are committed to ensuring that all those that were mis-sold these products get fair and reasonable redress. We are working hard to process cases as quickly as possible prioritising those businesses that are most in distress first."

© Copyright IBTimes 2025. All rights reserved.