Oil rallies on US data and growing interest in oil fund

Brent crude surges 9.4% for the week

Crude oil futures added over 1% on 6 February, and rallied for the week, buoyed by a stronger-than-expected US January jobs report, declining US drilling activity and growing interest in the world's largest crude oil ETF.

Brent March contract finished $1.23, or 2.2%, higher at $57.80 a barrel on Friday.

The global benchmark gained 9.4% higher for the week.

WTI March contract finished $1.21, or 2.4%, higher at $51.69 a barrel on Friday.

Light, sweet crude gained 7.2% for the week.

Upbeat US economic data should boost energy demand in the world's leading economy.

But a US dollar rally on Friday, on the back of the data, helped to dull those demand expectations, Phil Flynn, senior market analyst at Price Futures Group, told MarketWatch. A stronger greenback makes dollar-denominated oil more expensive for holders of other currencies.

The oil market also drew support from a Baker Hughes report, which said that the US oil and gas drilling rig count stood at 1,456 as of 6 February, or 87% lower from the preceding week.

Baker Hughes said that the US rig count had dropped 24% since early December 2014, hovering at its lowest level since March 2010.

Flynn said the US rig count drop was "a sign we've seen some substantial cutbacks in rigs and cutbacks in capital spending and that at some point, it's going to have an impact on US imports".

Earlier, Commerzbank Corporates & Markets said in a note: "The percentage daily changes experienced by Brent since [30 January] read as follows: +7.9, +3.3, +5.8, -6.5, +4.5. The last time we saw such high price volatility on the oil market was in April 2009 with the onset of a sustained price rally following the collapse sparked by the economic and financial crisis.

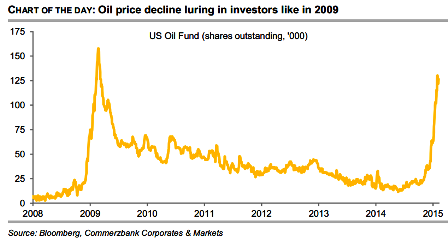

"We attribute the latest dynamic price surge first and foremost to a marked increase in investor interest. This is also indicated by the growing interest in the world's largest crude oil ETF, the US Oil Fund. Shares outstanding have soared nearly six-fold in just three months, and recently climbed to their highest level since early 2009.

"Many investors regard oil prices as low and are keen to profit from the anticipated price increase. We believe this optimism is premature right now. True, the decrease in the US oil rig count suggests that oil production growth in the US will flatten off in the foreseeable future.

"Nonetheless, the still high oversupply and largely negative news backdrop argue against any lasting price recovery at the present time. Saudi Arabia for instance has significantly lowered its March selling prices for Asian consumers.

...the fight between oil producers for market shares is entering its next round

"The discount on the Arab Light price as compared to the Oman/Dubai reference type has increased by 90US cents to a record-high $2.3 per barrel.

"In other words, the fight between oil producers for market shares is entering its next round..."

Moody's, in a 5 February report, said it had lowered its price assumptions for Brent crude to $55 a barrel through 2015 and $65 a barrel in 2016.

While it expects oil prices to eventually rebound as demand increases and low prices create an eventual supply response, as producers lower their capital spending, that supply response will not be meaningful until at least 2016, Moody's added.

Last week, Opec Secretary-General Abdulla al-Badri said he saw a possibility that oil prices could explode over $200 a barrel in the future, The Motley Fool reported.

Al-Badri, however, did not give a timeframe for the likely explosion in prices.

© Copyright IBTimes 2025. All rights reserved.