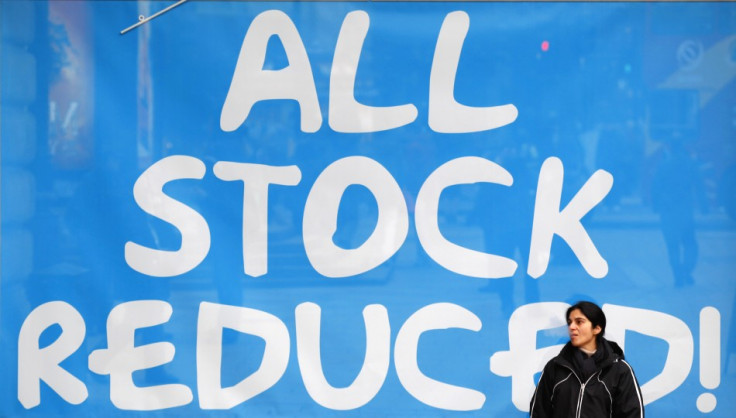

Overseas Christmas Shopping May Invite Extra Charges, Warns HMRC

HM Revenue and Customs (HMRC) has urged the UK public to be cautious about the extra charges they have to pay for online purchases of "bargain goods" from the non-EU countries.

The tax collector has issued the warning in view of the increased online buying and overseas shopping during the Christmas season.

HMRC has said that some purchases over the internet or by mail order from outside EU may attract additional charges in the form of Value Added Tax (VAT) and duty. Goods having value of more than £15 will attract a Value Added Tax (VAT), and purchases with value over £135 may invite a customs duty. However, it depends on the content and destination of the purchase.

"We know many people like to go abroad at this time to buy their Christmas gifts, or buy online from non-EU countries, and think that the 'cheaper' price they see is always the price they finally pay. HMRC is keen to remind the general public how much they can actually bring back from abroad or buy from an online overseas seller without having to pay import duty or VAT," said Angela Shephard, Head of Customs Policy, HMRC, in a statement. "You don't want to be faced with unexpected extra charges, when you thought you had found a bargain," she said.

Gifts other than monetary gift items valued over £40 from outside EU will attract an import VAT. To qualify as a gift, the item must be sent from one private individual to another, with no money changing hands. But the excise duty is always due on all alcohol and tobacco products purchased online or by mail order.

Customs duty is charged on goods imported from non-EU countries and varies according to the category and value of the goods.

© Copyright IBTimes 2025. All rights reserved.