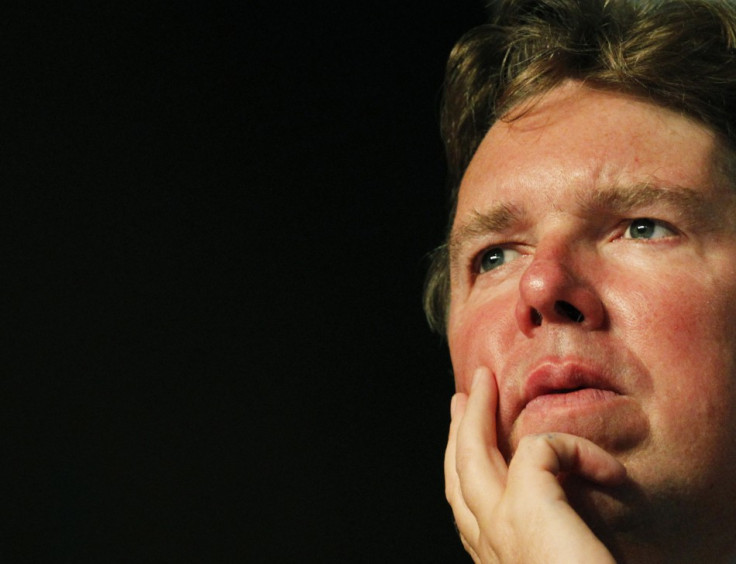

BoE's Paul Tucker: Banks 'Too Big to Fail' Is Still a Problem for Europe

Europe still faces severe problems when it comes handling its rotten bank sector, says outgoing Bank of England Deputy Governor Paul Tucker.

In a speech at a London School of Economics event, Tucker added that the US has done a superior job in protecting taxpayers from siphoning cash into failing institutions.

Tucker added that the US Congress has also been more decisive in giving the government the right tools to contain the fallout of the credit crisis.

"Were some of the biggest Wall Street firms to fail this week...I think it would be very hard for for the President and US Treasury Secretary to persuade the Congress to commit to taxpayers' money."

Tucker Hails US Approach

While Tucker enthused about the US' ability to handle failing banks, he also recommended that, in the case of another financial crisis, the BoE could "step aside" and let America unwind institutions, even if they have London operations.

"The capital structure of big firms is such that big banks could be shut down on a global basis", says Tucker.

"It could now be done under duress by the American authorities with the authorities elsewhere stepping aside."

The European Union has yet to write into law how it would break up and close banks that have become too unstable.

Therefore, US authorities stepping into the breach was a way round European policymakers' inability to act quickly, he argued.

The EU's difficulty in creating mechanism that would wind down failing banks is part of a deeper malaise of how to create a workable banking and fiscal union.

To strengthen the UK's ability to wind down banks, Tucker said the BoE will publish a paper over the next few weeks on bank supervision called "constrained discretion" that will develop ideas based on the Federal Reserve's stress tests of banks.

These efforts by the BoE come at a time when UK Chancellor George Osborne has expanded the role of the BoE in policing financial markets by creating the Prudential Regulation Authority and Financial Stability Committee.

Meanwhile Tucker, who is leaving to become an academic in the US in the autumn, attacked lobbying by banking industry as calls for softer rules will only weaken regulation and cause damage to the stability of the markets.

He called on banks to play a more constructive role in helping to create rules that would make them stronger and more accountable in the future.

© Copyright IBTimes 2025. All rights reserved.