Quadruple Real Rates? Ageing May Turn To Market Headwind: Mike Dolan

If you were hoping this was all a bad dream, take a deep breath.

Many investors craving some return to "normal" from the wild economic and market distortions of the pandemic and this year's war in Europe tend to rely on the glacial grind of ageing populations as guiding light back to trends of recent decades.

Shocks to supply of labour, goods, energy and food around COVID-19 and Russia's invasion of Ukraine will likely resolve themselves eventually while the world continues to grey regardless, many argue.

And as that inexorable force has for four decades created a "savings glut" depressing real interest rates and inflating asset values generally, it will return and overwhelm again.

But even that cold comfort now being rethought.

Over recent years some economists, including former bank of England policymaker Charles Goodhart and ex Morgan Stanley economist Manoj Pradhan, have argued that - unlike Japan's experience of deflation and falling economic potential - ageing populations and worker shortages may in fact prove inflationary.

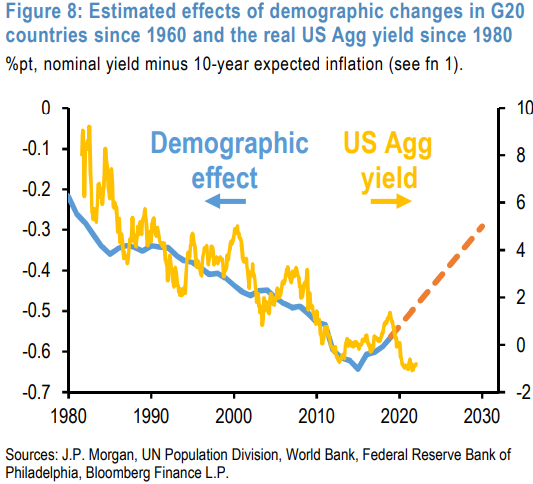

And this week JPMorgan's long-term strategists Alex Wise and Jan Loeys released studies suggesting the decades-long influence of demographics on savings and investment trends had already turned and would now be a factor forcing real, or inflation-adjusted, yields higher over the coming decade.

Even though population ageing continues, possibly even exaggerated by the pandemic, the JPMorgan model hinges on how it affects private and public savings behaviour relative to investment before and after big retirement waves.

The nub of the argument is that savings swelled over recent decades as outsize "boomer" population cohorts neared retirement and saw life expectancy after retirement increase sharply. People ramped up savings for likely longer twilight years out of work.

But now as they actually do retire and old-age dependency ratios rise, they actively run down those savings while governments also "dissave" even more to support them via healthcare and pension provisions.

Using data from almost 200 countries over 60 years to 2020, Wise and Loeys concluded there was a clear "demographic reversal" around 2015 as rising old-age dependency overtook life expectancy as the main household influence on savings and started to exert upward pressure on global real yields.

The link with government saving was less clear, but they forecast public dissaving would increase as the share of retirees mounts.

And it's the aggregate picture that matters most given that large pools of private and public savings have for year proven mobile across borders, not least in seeking safe havens and reserves in the likes of U.S. bond markets.

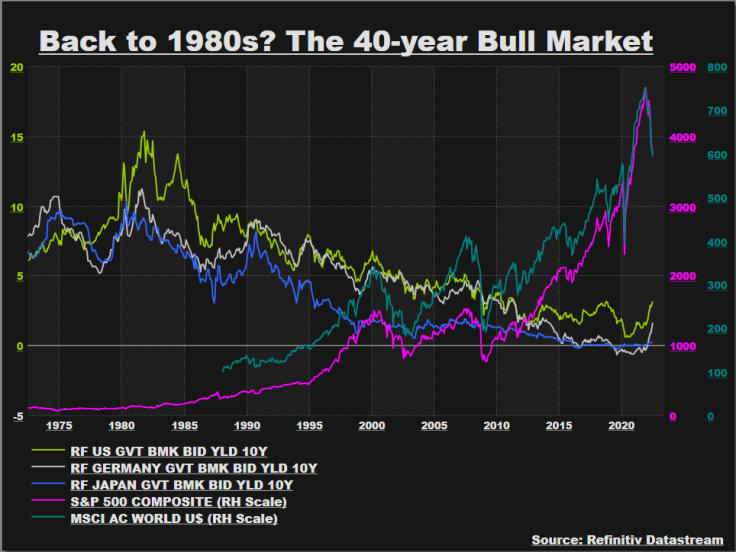

And much like the popular economic and TV trends of the moment, it could see us catapulted back 40 years in terms of bond market returns.

"By 2030, the effect of demographics on real interest rates will likely revert to a level last observed in the 1980s," JPM concluded, showing charts illustrating how extrapolated population and savings trends tallied with real yields on U.S. aggregate indices of all U.S. bonds.

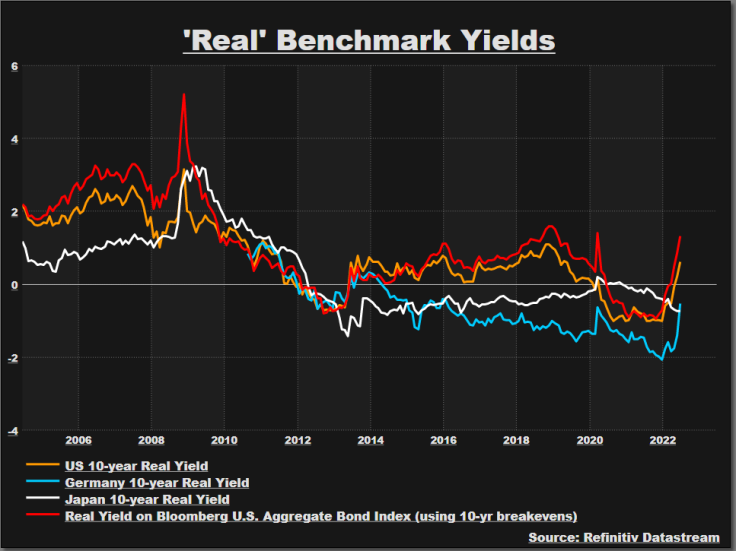

GRAPHIC: Real Benchmark Yields (

)

GRAPHIC: JPMorgan chart on Real Yields and Demographics (

)

BACK TO THE FUTURE

Given those parameters, a return to the 1980s could see U.S. Agg real yields back about 5% by the end of the decade from negative right now.

The implications of that shift in all asset market valuations could be immense.

To be fair to JPMorgan, they twin the paper with another showing how errors in long-range, or 10-year out, economic forecasts over the past 40 years tend to be large and over-optimistic and better in real rather than nominal terms.

Real 10-year Treasury yields have consistently undershot 10-year forecasts and the standing 2032 consensus forecast is for it to remain less than 1%. Against that, a 5% real yield outcome would be quite a shock indeed.

Yet in a season where many asset managers are compiling "secular" five-year outlooks that aim to see through prevailing inflation, policy and economic headaches, the demographic question is central to where you see the world re-emerging.

And not everyone is convinced it's changed that much.

Giant bond manager Pimco concluded this week that while the world has moved beyond the "new normal" of the teen years, it was only entering a "new neutral" period where low real rates would endure.

"The secular factors that have driven neutral policy rates lower - including demographics, the global savings glut, and high debt levels - will likely continue to anchor policy rates at low levels," Pimco's Joachim Fels, Andrew Balls and Dan Ivascyn wrote in their five-year outlook.

Nominal Treasury yields may be higher due to greater macro and inflation volatility, they added, and demand from investors for higher "term premia" to compensate for holding bonds over long periods.

But would a shocking re-rating of real yields along the lines of JPMorgan's model have an equally big impact on stock markets?

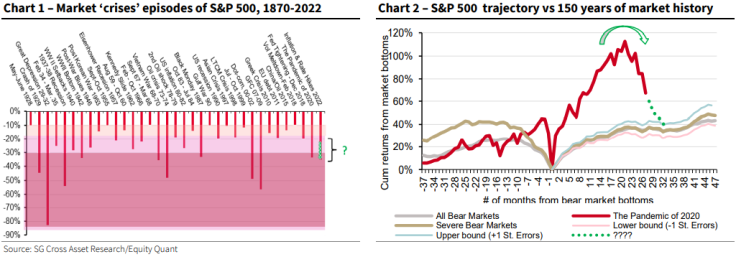

It would certainly tally directionally with long-range historical studies that suggest equity prices need to descend much further that the more than 20% they're suffered in this bear market so far.

Societe Generale's quantitative analyst Solomon Tadesse looked at market crises and recoveries over the past 150 years and concluded that the S&P500 needed to lose another 15% or so from here to be consistent with where valuations previously levelled out over that time.

But if 5% real yields were on the horizon, that may only be the beginning.

GRAPHIC: Societe Generale Chart on Market Crises (

)

GRAPHIC: 40-year Bull Market (

)

The author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his own

(by Mike Dolan, Twitter: @reutersMikeD; editing by David Evans)

Copyright Thomson Reuters. All rights reserved.