RBNZ Says NZD Headed for Fall and Hints at Pause in Hiking Cycle, Sending Currency to Multi-Week Lows

The Reserve Bank of New Zealand has raised the official cash rate in line with expectations but hinted at a period of pause before further hikes and said there is potential for a significant fall in the Kiwi dollar, sending it to multi-week lows versus all major currencies.

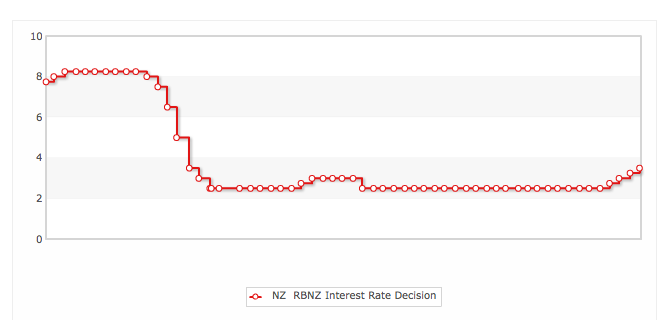

The RBNZ raised the OCR to 3.5%, a 4-1/2-year high, from 3.25% on Thursday. It has been the fourth straight meeting where the rate was raised by 25 basis points after it was kept at a record low of 2.5% for about three years.

"With the exchange rate yet to adjust to weakening commodity prices, the level of the New Zealand dollar is unjustified and unsustainable and there is potential for a significant fall," the RBNZ said in its policy document.

The NZD/USD fell from 0.8700 to 0.8608, its lowest since 12 June, following the rate decision.

"It is important that inflation expectations remain contained. Today's move will help keep future average inflation near the 2% target mid-point and ensure that the economic expansion can be sustained," the central bank said.

"Encouragingly, the economy appears to be adjusting to the monetary policy tightening that has taken place since the start of the year. It is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level."

It was this comment that has hinted at a likely pause in the RBNZ rates in the reviews ahead.

The GBP/NZD jumped to a seven-week high of 1.9795 from 1.9570 after the NZ credit policy while the EUR/NZD rallied to 1.5640, a three-week high, from 1.5460.

The NZD/JPY dropped to a six-week low of 87.38 from 88.26 while AUD/NZD rose to 1.0969, a six-week high, from 1.0860.

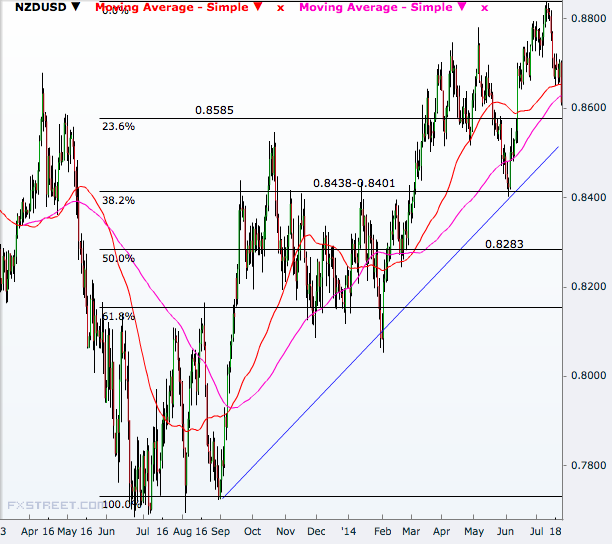

NZD/USD Technical Outlook

The pair has next support at 0.8585, the 23.6% Fibonacci retracement of the one-year rally to the 10 July peak of 0.8838.

The next Fibonacci level near the 0.8438-0.8401 area needs to be broken for the doors to the more important 0.8283 to open.

On the higher side, 0.8700 has now turned the first resistance, a break of which will open the doors to 0.8747 and then a retest of the 10 July high.

© Copyright IBTimes 2025. All rights reserved.