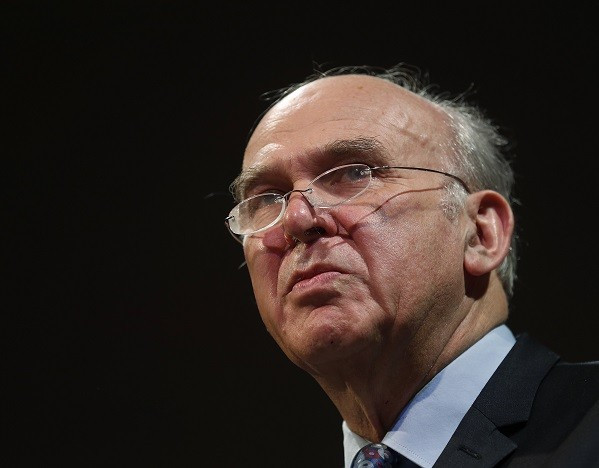

Royal Mail Shares: Vince Cable Advised 'Very Unwise' to Push 330p Offer Price Higher

Business secretary Vince Cable insisted he was given "very clear and unambiguous advice" that pushing Royal Mail's offer price higher than 330p would be "very unwise" because it ran the risk of target long-term institutional investors walking away from the controversial flotation and leaving it a total failure.

Cable was under the spotlight of parliament's Business Select Committee alongside business and enterprise minister Michael Fallon to defend the government's valuation of Royal Mail amid criticism that it seriously undervalued the company. Royal Mail shares stood at 566p at the time of publishing.

"The focus from the very outset is making sure we had the right kind of investors," Cable said.

"That dominated considerations rather than the extra bit you might have got from opportunistic traders."

Fallon said that it "became very clear to us that there was a point at which institutional investors wouldn't invest."

There has been criticism of the valuation process because it relied on consultation with institutional investors over the price at which they would be willing to buy Royal Mail shares. Some reports suggest institutional investors, such as pension funds, have been buying at a higher price than they had originally said they would.

Liberal Democrat Cable echoed comments made to the same committee by Goldman Sachs and UBS, the two "global coordinators" advising the government on the valuation, that the IPO was surrounded by major risks such as the threat of industrial action by workers over a pay dispute and the US government shutdown which weighed on the offer price.

'Value for Taxpayer'

Fallon said the government's priority in the Royal Mail sell-off was "overall value for the taxpayer".

This was not simply generating as much money as they could from the initial sale, he said, but setting a price that saw all 600 million shares sold.

It was also to ensure that Royal Mail could access capital markets when it needed to in the future, unlike Facebook which had to wait a year before it could return to the markets after its catastrophic IPO.

One of the biggest priorities was to protect the six days a week service through a successful privatisation, said Fallon.

The government also wanted to avoid setting a price so high that the value subsequently collapsed and left Royal Mail needing taxpayers to bail it out.

Cable said it could be as much as a year from the IPO before its success or failure could reasonably be assessed and that it is too early to judge.

CWU

The committee questioned Cable and Fallon over the scale of the risk from the pay dispute between the Communications Workers Union (CWU) and Royal Mail. The two ministers were asked why they did not delay the IPO until the dispute was resolved and the threat of strike action removed.

Fallon said he had been consistently promised that a resolution to the dispute was imminent since the end of 2012, but had been let down several times.

"It was very clear to us by August that there was no point in waiting for a deal. There was no real prospect of a deal and there was no real incentive for the union to reach a deal before the IPO was launched," he said.

Cable said ministers decided to proceed because the risks to pushing back the IPO outweighed the benefits.

Andrew Bailey, chairman of the committee, said the success of the flotation given the dispute was still unresolved at the time raised doubt over the assertion that markets were fearful of the impact of strike action.

At a previous hearing, James Robertson, managing director at UBS, said Royal Mail bosses had privately warned the Swiss investment bank in September during its pricing work ahead of the flotation that a pay deal with the CWU was unlikely and that industrial action would probably take place.

"Up until September we were hoping to get a pay deal and hoping to do the IPO on the backdraft of a positive industrial relations scenario," Robertson told MPs on the business select committee at a hearing on the Royal Mail privatisation.

"From September onwards, [industrial relations] was the major risk factor."

He was pressed by MPs on how much the threat of strike action had dented the Royal Mail's valuation range by, but he said he could not give an exact number. Robertson was also asked why UBS did not advise that the flotation be delayed until the dispute was resolved.

"There was no evidence with the feedback from the company that [the dispute] would have been resolved before an IPO took place," he said, adding that much of the dispute was centred around the firm's privatisation anyway.

© Copyright IBTimes 2025. All rights reserved.