Russia and China Agree to Second Mammoth Gas Deal

Russia will supply China with an additional 30 billion cubic metres (bcm) of gas per year, after the respective governments signed an agreement in Beijing.

Added to the $400bn (£252bn) deal to export 38bcm of gas to China signed in May, it raises the prospect of China becoming the biggest recipient of Russian gas and could be a landmark moment in Russia's efforts to diversify its trade routes away from the West.

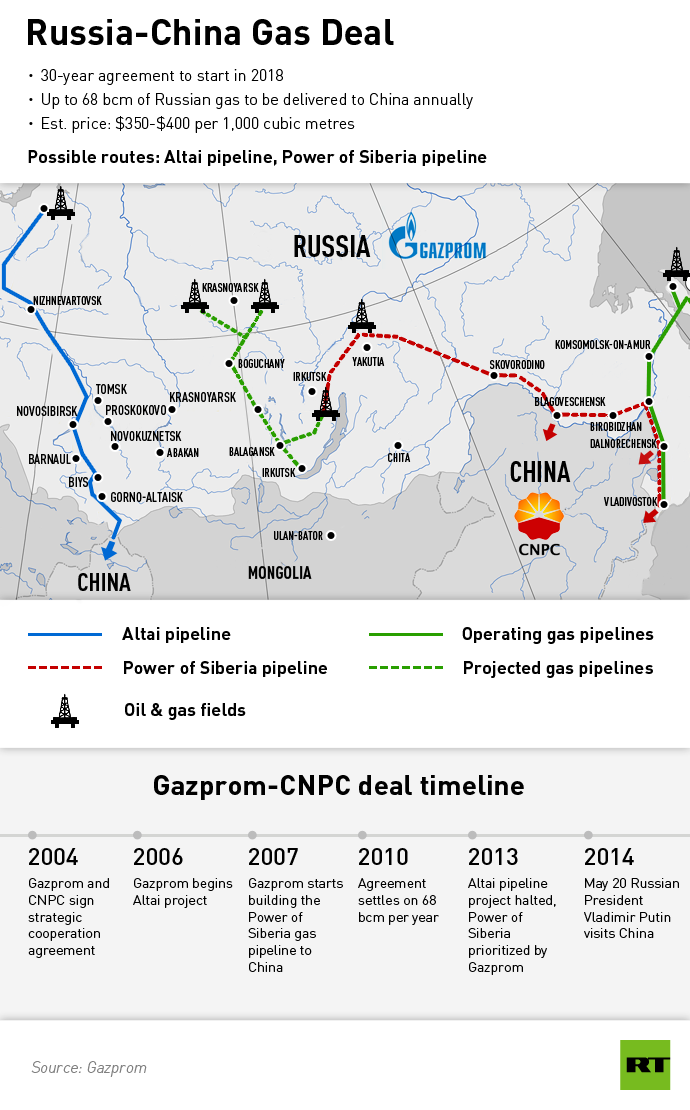

The new "western" or "Altay" route would transport gas from Western Siberia to China and should provide some tonic for the Russian President Vladimir Putin, as the Russian economy threatens to crumble beneath his feet.

Bilateral sanctions between Russia and the West, coupled with oil prices which have spent most of the year in freefall have left the economy teetering on the brink of recession. It is forecast by the OECD to report zero growth in 2015, but many analysts' predictions are much bleaker.

The framework agreement signed with China is a boost for Putin's foreign and economic policy, with the West continuing to mull fresh sanctions, given the Kremlin's official recognition for the nascent government in Eastern Ukraine.

The CEO of Gazprom – which will provide the gas to the Chinese National Petroleum Company (CNPC) – welcomed the memorandum of understanding and said it could lead to China usurping Europe as Russia's biggest gas customer.

"Supplies will go from fields in West Siberia - the resource base we are using for supplies to Europe. In the mid-term we have another route, which is being negotiated with China now - gas supplies by a pipeline from regions of the Far East. As we shall be increasing the supplies along the western route, in mid-term the supplies to China may be bigger than the export to Europe," said Alexey Miller.

However, Miller moved to dampen speculation that China would issue prepayment or loans on the back of the agreement.

Itar Tass reports him as saying: "We had negotiations [with China] – as far as a prepayment is concerned; and a prepayment was an element of the talks on price. But since we have agreed finally on the price, we do not consider as possible using a prepayment as a financial instrument for further lowering of the price. We are not negotiating loans."

© Copyright IBTimes 2025. All rights reserved.