Serbia Woos Foreign Investors with 10 Year Corporate Tax Holiday

Serbia's investment agency unveiled a raft of key tax incentives and impending governmental reforms in a bid to make the region one of the most attractive countries in the emerging economies to invest in.

Speaking with IBTimes UK in a private meeting in Belgrade, the Serbia Investment and Export Promotion Agency (Siepa) revealed that if a foreign company invests an amount exceeding €9m (£7.6m, $12.2m) in fixed assets, and will employ at least 100 additional employees throughout a 10-year period, then the group is exempt from paying corporation tax for a decade.

"We have one of the most attractive tax systems in Europe as our corporation tax is only at 15% and further incentives are on offer if businesses decide to come to the country," said Drasko Nikolic, chief of cabinet at Siepa.

"We have many competitive advantages for manufacturing, R&D and exporting businesses in Serbia but the main hurdle is public perception," added Vladimir Tomic, assistant director for foreign direct investment (FDI) at Siepa.

Depending on FDI

Between 2001 to 2012, Serbia received over $20bn worth of FDI, beaten only by Romania in the list of south eastern European countries receiving mass investment.

In 2011, Serbia attracted more than €2.2bn of cash FDI, which is higher than all its "immediate competitors", many of which are already European Union members.

Siepa's latest figures show that Italy is the biggest investor in the country with 15.2% of FDI, while Austria comes in second with 12.6% and Greece comes in third with 9.3% [Figure 1].

![Figure 1 [Chart: Siepa]](https://d.ibtimes.co.uk/en/full/416831/figure-1-chart-siepa.jpg?w=613&f=e9660dde33bb4a0c51413a866874a982)

Britain ranks 12<sup>thwith 3.9% in the list for largest foreign direct investments.

"Serbia is being much more export oriented as growth come from foreign investments," said Tomic.

"We have too many state-owned companies that serve to create artificial employment and this has hurt Serbia's competitivity in the past in the world market.

"However, we are moving more towards privatisation and already have an advantageous tax system that makes it extremely attractive for companies to come here."

Italian carmaker Fiat announced plans for a €1.3bn plant in Serbia, employing 2,400 workers.

The group voiced major support for Serbian government participation in the joint venture and its provision of incentives, including tax breaks, infrastructure and training.

Tax Advantages

On top of the tax holiday, Serbia has one of lowest tax rates in Europe [Figure 2].

![Figure 2 [Chart: Siepa]](https://d.ibtimes.co.uk/en/full/416832/figure-2-chart-siepa.jpg?w=736&f=0a5596819c47e4ac60bd039c3aa45954)

Workers only pay 10% of their salary in tax while corporation tax remains at 15% before exemptions. Value-added-tax (VAT) is at 20% but export and custom duties are either very little or don't exist.

According to Ernst & Young's European Attractiveness Survey 2013, Serbia has become one of the key places for foreign investors looking to grow their business abroad.

FDI created 10,302 jobs in the country, which ranked sixth in Europe for FDI job creation. Serbian projects are among the most labor intensive in Europe, creating 132 jobs each on average.

Nearly 90% of projects in Serbia came from European companies.

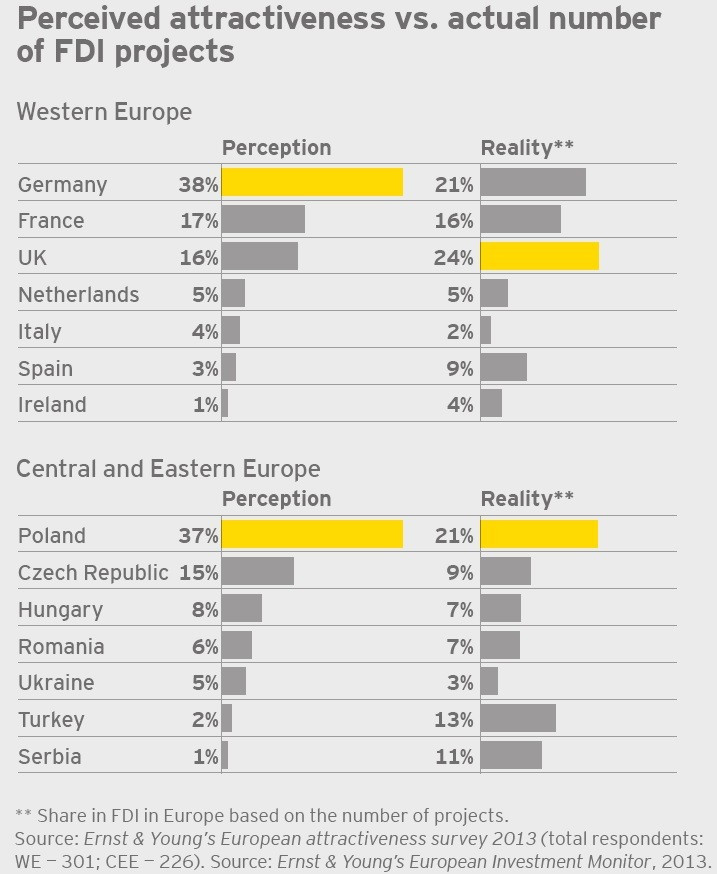

Notably, E&Y revealed that perceptions of doing business in Serbia vastly differed from reality [Figure 3].

Meanwhile, PricewaterhouseCoopers ranked Serbia as the third most attractive manufacturing and seventh most attractive services FDI destination among emerging economies.

Don't forget to check out IBTimes UK for the full interview and a range of special written and videos reports on Serbia.

Related Articles:

Serbia Finance Minister Lazar Krstic Tackles 'Grey Economy' in €1bn Tax Evasion Clampdown

Serbia in Focus: 60,000 Jobs at Risk in Privatisation Shift

Serbia's Deputy PM Aleksandar Vucic: We Must Fight Scourge of Socialist Corruption

© Copyright IBTimes 2025. All rights reserved.