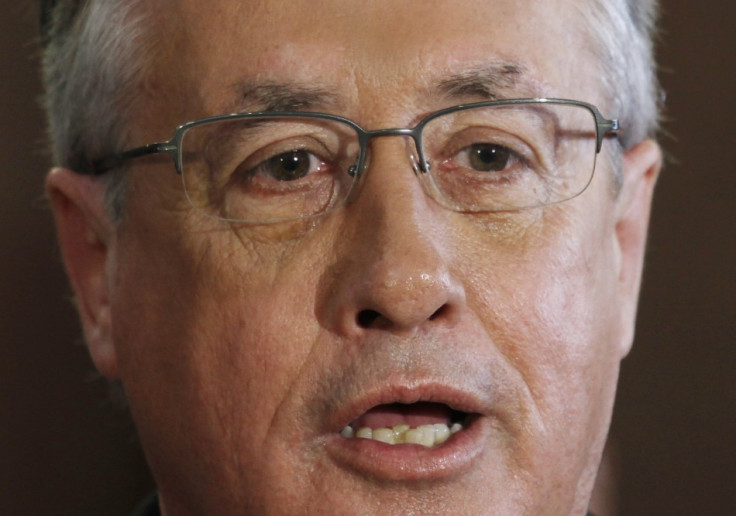

Australia's Wayne Swan Rallies G20 Over Corporate Tax Evasion

Australia's government is rallying fellow G20 leaders with a call to eliminate corporate tax avoidance and evasion by knotting loopholes, ahead of its chairing of the group in 2014.

Multinational giants such as Google and Starbucks have faced heavy criticism across the world over their efforts to reduce their tax burdens by shifting profits and revenues around the world to offshore and low-tax hubs, regardless of where the money was generated.

"The aggressive tax practices of some multinational and other large companies is an increasing focus of many G20 countries," said Wayne Swan, Australia's finance minister, announcing his Budget for the year.

"Businesses that aggressively exploit tax loopholes gain an unfair advantage over their competitors."

Swan's words come after an agreement between Australian, US and British tax authorities to work together by sharing data in a bid to clamp down on tax-evading companies and individuals.

"This is part of a wider effort by the IRS and other tax administrations to pursue international tax evasion," Steven T. Miller, acting commissioner of the US tax office the Internal Revenue Service (IRS).

"Our cooperative work with the United Kingdom and Australia reflects a bigger goal of leaving no safe haven for people trying to illegally evade taxes."

Tax evasion costs the UK an estimated £5.2bn a year in lost revenues.

Avoidance, which is legal and different to evasion, has been the focus of public ire in recent months as government austerity bites down hard on ordinary Britons.

Big firms such as Google, Starbucks and Amazon, who generate billions of revenue from their UK hubs, export profits around the globe to reduce their tax bills in the country.

A recent parliamentary report accused the UK tax office, HMRC, of having an incestuous relationship with the big tax firms who help big business with avoidance.

"The large accountancy firms are in a powerful position in the tax world and have an unhealthily cosy relationship with government," said Margaret Hodge MP, chairwoman of the Public Accounts Committee, which issued the report.

"They second staff to the Treasury to advise on formulating tax legislation. When those staff return to their firms, they have very inside knowledge and insights to be able to identify loopholes in the new legislation and advise their clients on how to take advantage of them. The poacher, turned gamekeeper for a time, returns to poaching.

"This is a ridiculous conflict of interest which should be banned in a code of conduct for tax advisers, as we have recommended to the Treasury and HMRC."

In November HMRC gave an award to Will Morris, director of global tax policy at General Electric (GE), the US's largest corporation, for helping it run the tax system in Britain - despite the company's prolific tax avoidance record in America.

© Copyright IBTimes 2025. All rights reserved.