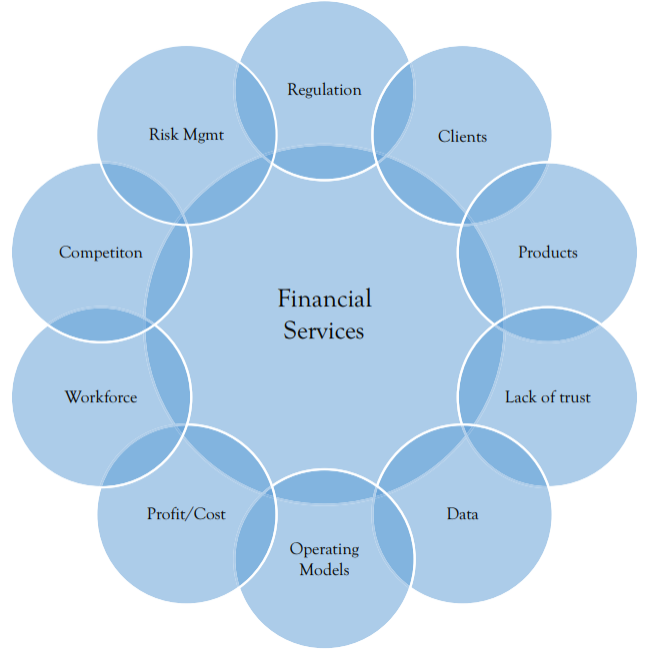

The ten challenges impacting the financial services industry

To ensure it survives and prospers, the financial industry needs to overcome ten challenges, and it is vital that they do.

The financial services industry is essential to the day-to-day running of the global economy However it is now facing a number of challenges which it needs to manage to ensure it both services and prospers.

"Tsunami" of New Complex and Business-Critical Regulation

Arguably, the most prominent factor at the moment is Regulation or, more specifically, the "tsunami" of new regulations which is inundating the Asset Management industry following the credit crisis of 2008. This wave of new and updated regulation is set to continue for the foreseeable future. This complex set of existing and new global regulations is and will continue to provide many challenges to the industry. For example, increased costs to comply which is squeezing profit margins, an adverse impact on innovation increases complexity.

These challenges are, in turn, forcing the industry to change the way they work. Firms need to review cultures, capital requirements, product development processes, investment strategies, marketing approaches, distribution, their operating model and associated infrastructures as well as develop the ability to complete regulatory returns.

Firms also need to develop new capabilities to comply with data protection regulations covering the ability to collect, retain and process data and manage information. In the UK and European Union, this area has recently been strengthened by the recent implementation of the General Data Protection Regulation (GDPR) on May 25, 2018. GDPR itself is a complex law with severe penalties for non-compliance.

The industry needs to be aware of any unintended consequences caused by the new regulation, especially to Investors. For example, new regulations to monitor the risk profile of a portfolio could result in firms putting pension funds in lower-risk investments which could harm their long-term investment returns. Also, some of the new regulations are costly to comply with (such as central clearing of Over-the-Counter derivatives) which means firms could not use them which, again, could ultimately impact their end client.

Firms also need to cope with the changing (and still unclear at the time of writing) landscape caused by BREXIT. In light of BREXIT, the Government is looking at various pieces of EU regulation that may be removed or modified in UK law to better suit the UK financial services industry; for example: Lord Hill's UK Listings and Prospectus reviews. This may lead to those firms operating in the UK and the EU having to operate two regulatory regimes side by side to accommodate the diverging regulations.

Therefore, it is now essential that firms develop capabilities to ensure they can comply with these regulations. Some commentators have joked by saying that regulation is the biggest growth area within Financial Services.

The Changing Nature of Clients

As discussed earlier, the Financial Services industry has a wide range of different types of clients which range from very large multi-billion pound multi-national organizations, using many products, down to individual retail clients who may only have a simple bank account.

However, the dynamics of this group are changing.

Since the credit crisis in 2008, Investors are becoming more knowledgeable and they are focusing their attention on a wider range of activities. For example, performing reviews on the firms' products, usability and fees. They are also looking for Managers to take a more ethical attitude with their investments (hence the increase in demand for ESG-compliant products). Clients are now more willing to change providers on a more regular basis and initiatives such as open banking will enable these changes.

Secondly, the dynamics or the "make-up" of clients are changing. At a global level, life expectancy has risen by 50 per cent, the world population has risen and there has been a sharp rise in the ratio of global wealth to income. This means there are more savers, younger savers, older savers and richer savers. This global change directly impacts the profile of the group. At the lower Retail end of the business, the impact is more obvious because more savers will mean more Retail clients. However, there will be impacts to the higher end because more savers will mean bigger Pension Funds and increased tax revenue which will boost the size of Sovereign Wealth Funds.

Thirdly, clients are taking on more responsibilities for managing their assets and liabilities. A prime example of this is the move from Defined Benefit pension funds in the UK to Defined Contribution funds where the emphasis is on the client to proactively manage investment decisions. Second, there has been an increase in High net worth individuals and Sovereign Wealth Funds with more diverse agendas and challenging investment goals.

Consequently, the industry needs to understand that the clients' perspective of value is getting tough and it will need to get much smarter at understanding what clients value.

The Changing Nature of Products

There is an also ongoing sea-change in the types of products within the industry. There are a large number of products in the industry that are currently being rationalized into fewer products but with a greater concentration. This change has been driven by the following factors.

Firstly, the increased burden of regulation has resulted in many products being too costly and complex to run. Historically, firms have never really understood the costs behind their products mainly because the margins were large enough that costs always appeared immaterial. However, since the introduction of more regulation the costs and complexity to comply have increased which has resulted in many products being uneconomical.

Secondly, client demands have evolved which means many products do not meet their clients' needs. Using Asset Management as an example; product ranges are moving away from pure alpha equity-managed returns to products focused on advice and outcomes balanced against cost and investor liquidity needs. Defined Benefit pension funds nowadays are more interested in having dedicated cash flows to meet pensioner payments (i.e., outcomes) as opposed to having their investments outperform the FTSE-100 by 1 per cent each year (i.e., alpha returns). Also, firms have to develop and offer products that support sustainability and the global trend to tackle climate change.

Finally, firms tended to be distant from their Investors and did not offer any significant personal or customer service. However, firms need to ensure the Product Offers are expanded to provide much better customer service elements going forward.

Lack of Trust in the Industry

The fourth characteristic within the industry is the lack of trust that clients (and the general public) have in the entire industry. There has always been a lack of trust in financial services firms but this trust was destroyed by the Credit Crunch of 2008. The lack of trust has been kept going by a constant associated stream of damaging media stories covering areas such as general incompetence, poor customer service and undeserved bonuses.

While certain parts of the industry (say Building Societies or Asset Managers) could reasonably argue that they were not part of the cause of the credit crunch, because it was caused by Investment Bankers and their actions, they are deemed "guilty" in the public's eye. Therefore, firms must have sufficient governance and risk capabilities to try and increase trust.

This characteristic can be split into two areas: namely, tangible capabilities and intangible capabilities.

The tangible capabilities are primarily driven by the new regulation currently being implemented. This regulation is forcing firms to implement greater oversight responsibilities, new governance models and new processes to support decision-making, risk management and transparency. The challenges of implementing this have been discussed in more detail above.

However, the other grouping is intangible capabilities with items such as cultural change, behaviour change and ensuring that no silos exist to stop the flow of data. This area is far more challenging because changing deep-rooted behaviours is a complex task. Firstly, individuals themselves will need to change and then their interactions with other individuals will then need to change. This is an area that the regulators are particularly focusing on.

The Need for Accurate Data

The fifth characteristic of the industry is the need for timely and accurate data. This is essential to all parts of the industry and it could be argued that this is the "blood" of the industry.

Currently, data is required for understanding client bases, managing the investor's assets, managing distribution channels, completing regulatory returns, cost/profit management, governance processes, product management and decision-making.

Looking forward (and as this book will demonstrate) more data will be required to support future changes such as supporting newer technologies (such as Machine Learning), monitoring climate footprints and self-servicing plus many others.

Unfortunately, many firms struggle to produce timely and accurate data due to major efficiencies in their operating and technology platforms. This is discussed further below.

Poor Operating and Technology Models

The sixth characteristic of the industry is the constant challenge that operating and technology models have to keep pace with the changing nature of the industry.

Historically, these operating models have been costly to operate, rarely "fit for purpose," and hard to manage. They consist of a complex piecemeal set of duplicate, ineffective and poorly implemented technology, a variety of in-house manual processes and various third-party outsourced arrangements covering various and duplicate functions. However, the demands of extra regulation, more demanding customers, new product ranges, requirements for online access and the need for accurate and timely data as well as superior governance processes will place more pressure on these already struggling platforms.

These extra demands will stretch the already struggling capabilities of these operating models because they will be expected to cope with more demands. The result is that various processes and technologies are "bolted" onto the side of the operating model which only increases their "patchwork quilt" nature. It will also start to open up newer risks such as the increased presence of cyber-risk caused by firms "opening up" their operating models to allow external clients online access.

Some firms have looked at various change initiatives to make a step change to improve their operating model. These can range in size from small system upgrades to massive business transformation activities. However, the industry has a poor record in implementing change and many of these change initiatives do not provide the benefits hoped and could make the situation worse or more "cobbled together."

Profit and Cost Pressures

The majority of firms are economic firms as in they need to make a return of some sort (normally a profit). There are a few firms that are non-profit making (such as a pension fund owning the Asset Manager who manages their assets or mutually held building societies who are only responsible to their customers) but these firms will still need to generate sufficient income to cover their operating costs.

However, the constant demands mentioned in this article are increasing costs as well as reducing revenue which means managing costs has become more and more challenging.

Changing the Nature of the Workforce

This is a major challenge for the industry and covers three main areas such as increasing workforce and cultural diversity, the impact of COVID-19 and the move to home working and improving the work-life balance.

Increasing Workforce and Cultural Diversity

It is fair to say the financial services industry had a major image problem that caused blockages around the workforce and cultural diversity.

There was a perception that all people who worked in the industry were "loud-mouthed" arrogant people who worked long hours with the focus on making as much money for themselves as possible often to the detriment of other staff members, other industry participants and their clients (i.e., the people who they were supposed to be servicing). This perception was often reinforced by the media and some high-profile films during the 1980s. This behaviour resulted in extreme risk-taking (or completely ignoring risks). It was very much the case that if the money was coming in then everything is good.

This reckless behaviour caused some issues:

- Firstly, there were some cultural "defects" that created massive market risks. For example, money was loaned to individuals who clearly could not pay it back, or complex Credit Default Swaps were created with large exposures that individuals did not fully understand. Once these risks started to crystallize this caused a chain of reactions which caused the credit crisis of 2008 to bring down several financial services firms and severely weaken the entire global economy.

- Secondly and just as importantly, it severely restricted workforce diversity. While it is fair to say that not all people in the industry matched the stereotype listed above, there was a clear perception that all people in the industry were like that. Therefore, as somebody's perception is their reality it did discourage and marginalize certain groups (e.g., females, BAME, LBGT plus others) across the industry. There is a large amount of evidence that diverse workflows produce better outcomes that are good for the firm and customers (i.e., the people whom firms are supposed to support).

- Regulators are looking to implement new rules to force firms to change their cultures and ways of working. For example, the UK has recently implemented a new regulation called Senior Managers and Certification Regime (SMCR) which makes individuals responsible for certain aspects of a firm's activity. Failure to comply could result in criminal prosecution. It is hoped that by making individuals responsible risks will be managed better.

- Secondly, firms are looking to improve diversity across their firms to ensure previously under-represented groups are grown. This involves "carrot" tactics such as encouraging and, if necessary, positive discrimination as well as "stick" tactics where disciplinary measures could be evoked if individuals block diversity.

This is very much a live issue at the time of writing. Speaking from a UK point-of-view, in March 2020, nearly all financial firms had to move to a home or remote work almost overnight. This created some immediate issues that both firms and individuals had to adapt to almost immediately.

Most firms have to split their workforce between the office and remote working. Office working covered functions that could not be done remotely (such as opening bank branches) and these were subject to strict COVID-19 restrictions such as social distancing. All other functions had to move to a remote or home method. Therefore, firms had to adapt their operating model to support remote work.

IT technologies are needed to support hundreds, if not thousands, of staff working at home. These changes changed the risk profile of firms with cyber and operational risks becoming more prominent. Furthermore, the management staff had to change to reflect this remote nature with different methods being used for supervision and communication.

There were also impacts on the actual staff. There has been a blur between life and work. People have had to cope with childcare arrangements. Individuals have also complained about working longer hours, not being able to switch off from work, social isolation, domestic issues and other mental health issues.

Having noted these issues, there have been some advantages. Having an operating model split across many locations provides natural Business continuity planning ("BCP") because firms' operations are not completely dependent on a few central locations. Furthermore, some firms are looking to reduce costs by either non-renewing or extending rent on expensive property. Also, staff have enjoyed spending time with their families as well as not having to spend many hours on the daily commute.

As the COVID-19 restrictions have started to relax, firms are now looking at how they can bring their staff "back into the office." While we are still in the early stages, it is safe to say that the working model will be different. It is unlikely that all staff will return to the office. While some staff will have to return to the office full time (e.g., bank branch staff or those who require very specific technology), there will be a hybrid model for others with some working at home for some or all of the time.

Therefore, firms will need to implement the operating model, technology, staff process and risk mitigation processes to cover this.

Work-Life Balance

There has been a long debate about improving the work-life balance for financial services firms' staff. There is a clear perception that staff works long hours (often with a long commute) which means a poor non-work life (e.g., reduced family and social time). As noted above; in the postCOVID-19 work, firms will likely allow staff to work at home for some or all of the time. This could make some changes to the work-life balance. However, (again as noted above) firms will need to implement the operating model, technology, staff process and risk mitigation processes to cover this.

New Competitors and Market Entrants

The Financial Services industry has traditionally been dominated by the same set of firms for many years. While the makeup of the firms has changed, it is often caused by existing firms performing mergers, demergers, or takeovers.

In recent years, several genuinely new firms have entered the market. Some struggle with the weighty entry barriers around regulatory compliance, operating models, technology, distribution channels and costs. Therefore, either these new entrants fail or are taken over by an existing player. Alternatively, our new entrants are boilerplates of existing players. For example, several supermarkets launching investment products but they are effectively distributing products that are supported by existing players.

The growth of technology (i.e., the theme of this book) has allowed new players to enter the market. For example Apple Pay, Google Pay and Cryptocurrencies. Although it could be argued that these entrants are only improving an existing service (e.g., payments) as opposed to offering something completely new, it is important to note that some of these new entrants (e.g., cryptocurrencies) are at higher risk because they are not regulated appropriately.

There are also some less obvious new entrants. For example, some larger Pension Funds (i.e., an Investor) are building capabilities for them to directly manage their assets and to reduce their reliance on external Managers.

However, having a constant flow of new and credible entrants is beneficial to any industry. This is because new entrants will highlight gaps in the market and/or improve existing offerings which will both bring the industry forward and improve the offerings for customers. Also, new entrants ensure existing market players are kept "on their toes" to ensure their offerings are constantly improving which, in turn, is in the interest of customers.

The Need to Manage Risks

There is also a key theme for Firms to manage their risk profile and appetite. This has stemmed from the credit crisis in 2008 where (with hindsight) a large number of firms did not have the correct risk controls in place which meant they had large exposure to risky investments (such as property and Contract Default Swaps).

Risk covers many areas such as operational risk (i.e., errors or problems with the operating model), regulatory risk (i.e., the possibility of purposely or accidentally not complying with regulations), market risk (i.e., the chance of prices and exchange rates changing causing a financial loss), credit risk (i.e., borrowers not paying back money loaned to them or for counterparties not settling trades on time) and cash risk (i.e., running out of cash for day-to-day operations).

Therefore, firms (with the insistence of regulators) now carefully monitor their risk profiles to ensure they are fully understood and controlled.

The cost to the industry of monitoring and management of risk is huge. However, with the regulatory focus on risk and the broadening spectrum of risks to be managed, the cost to the firm of not managing it effectively is even bigger.

Paul Taylor MBA, MBCS, FRSA, CMgr, FCMI, FHEA, MIOD, is a consultant with over 30 years' experience of implementing change across the financial services, oil/gas, charities and professional bodies. He is an author and speaker on a variety of subjects (such as Change, freelancing, technology, financial services, research approaches plus others). Paul has also published several books covering financial services, technology, contracting and change.

Furthermore, Paul is Chair and NED for a variety of industry and social enterprises and he is a mentor to various people on areas on career planning, career changes, etc. Currently, he is an associate Lecturer for the Open University STEM School teaching Technology Management.

© Copyright IBTimes 2025. All rights reserved.