Osborne's Budget 2013: Income Tax Relief Won't Ease Pain of VAT Hike, Says TUC

Britain's poorest workers pay out four times more because of the VAT hike to 20 percent than they will gain back from the government's plan to increase the personal allowance to £10,000, according to research by the Trades Union Congress.

The coalition government has held up its lifting of the personal allowance threshold – the point of earnings at which an individual starts paying tax – as an example of how it is helping make the lowest paid workers in society better off.

"Contrary to ministers' claims, the biggest losers from the government's tax policies are the poorest households," said TUC general secretary Frances O'Grady.

"If the chancellor really wants to make a difference to family budgets he should look at reversing his VAT hike and cuts to vital tax credits and benefits."

VAT was increased from 17.5 percent to 20 percent on 1 January 2011 as part of the Chancellor's emergency budget.

Lifting the personal allowance threshold by £100 is ten times cheaper for Chancellor George Osborne than cutting VAT by a penny. HMRC estimates say raising the personal tax allowance by £100 in 2013/14 would cost Osborne £510m. Cutting the rate of VAT by just a penny in the pound would cost him £5.1bn.

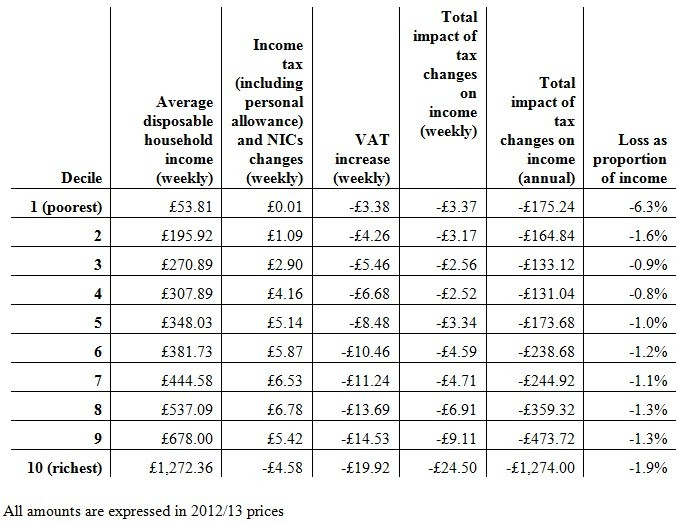

TUC analysis shows that the poorest income group for working households, who receive just £195.92 a week, are 1.6 percent worse off a year when you take into account the effect of the VAT and personal allowance increases.

The VAT increase has left these households with £4.26 less a week, while the personal tax allowance changes leaves them with just £1.09 more each week.

Annually, the combined effect of the tax changes to VAT and personal allowance leaves this group £164.84 worse off.

Labour has called on the government to slash VAT back to 17.5 percent to ease the financial pressure on hard-pressed households, as well as stimulate more consumer spending in the dampened economy, but Osborne maintains that this is too expensive at a time when the public debt pile is soaring to new highs and there is a deficit in the Treasury's finances left behind by the previous administration.

Ed Balls, the shadow chancellor, has also called for the government to boost the economy by temporarily slashing the bottom income tax rate, paid for by more borrowing.

Balls argues that the economic growth spurred by such a tax cut would pay off the cost of borrowing more to do it.

"If George Osborne announced a temporary cut in the basic rate we would applaud him because we would say, 'At last he is finally doing something to get some spending power back into the economy'," Balls told the Daily Telegraph in an interview.

As of April this year, the top tax rate will be slashed by 5p to 45 percent, a move blasted by Osborne's critics as handing more money to the wealthy while slashing public services and welfare for the poorest in society.

Osborne says this will result in more people paying the top rate rather than hiding their money elsewhere, and should yield bigger tax receipts as a result.

He also lowered the threshold for the higher rate of 40 percent, scooping 400,000 more workers into this tax bracket as of the 2013/14 fiscal year.

The personal allowance will rise to £9,440 from April, with the coalition pledging to eventually increase this to £10,000.

Osborne will deliver his 2013 Budget on March 20.

---

Follow @shanecroucher

© Copyright IBTimes 2025. All rights reserved.