UK budget winners and losers: the pound, gilts and stocks

Finance minister Jeremy Hunt presented less gloomy forecasts for Britain's economy at his Spring Budget on Wednesday.

Finance minister Jeremy Hunt presented less gloomy forecasts for Britain's economy at his Spring Budget on Wednesday.

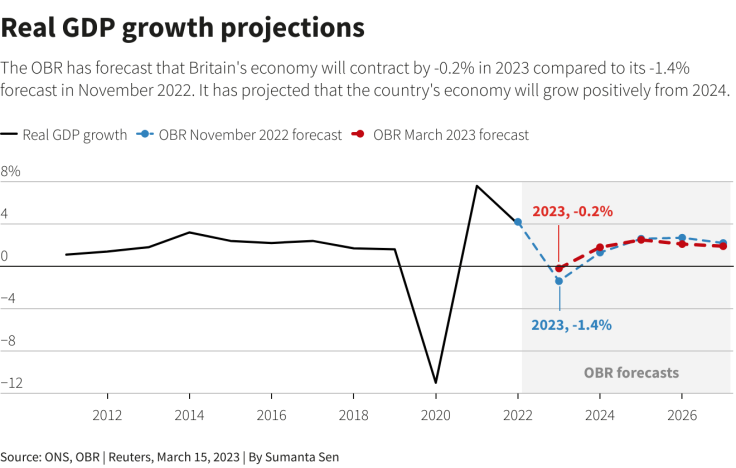

Upgraded official forecasts showed Britain, the only one of the G7 group of large economies not to recover to its pre-pandemic size, would now avoid a recession this year.

"International investors will be constructive around the type of budget we've had today, which suggests a calmer approach to managing the UK," said Edward Park, chief investment officer at Brooks Macdonald in London.

GRAPHIC - Real GDP growth projections

ROSIER OUTLOOK

A rout in global banking stocks on Wednesday overshadowed many UK-specific moves. But some analysts tipped a medium-term boost for gilts and sterling, as Hunt's Budget returned a sense of fiscal conservatism that was lost last September when former prime minister Liz Truss' presented unfunded tax cuts in a badly received mini-Budget.

Public borrowing estimates were revised lower and Hunt also avoided major spending sprees or big tax cuts. Some viewed the official forecasts as too rosy.

"Unlike the OBR, we do not think the UK will escape a recession," said Hetal Mehta, senior European economist at fund manager Legal & General Investment Management.

INTEREST RATES

The OBR's view did not encourage traders to place bets on more aggressive rate rises from the Bank of England.

Investments announced by Hunt such as a corporate spending tax break, a boost for defence and extra childcare support were not viewed as particularly inflationary.

"Most of the new measures are designed to boost the economy's supply side," according to Pantheon Macroeconomics chief economist Samuel Tombs, instead of stoking demand.

After Hunt's statement, money markets tilted towards the BoE holding off from another interest rate hike at its March meeting, putting a probability of 58% on no change. Last week, expectation of a BoE rate pause stood at around 10%.

STERLING

Sterling rose 1.2% to its highest level against the euro this year, as the currency pair most closely associated with the UK outlook reacted to the official view that a recession will be avoided in 2023.

The pound fell 0.85% against the U.S. dollar to $1.2055, however,, as global investors dived into perceived safe-haven assets.

"Despite the budget over-delivering in terms of spending relative to expectations, thus prompting a positive surprise in the OBR's issuance plans for 2023/2024, it seems as if markets just don't care," said Simon Harvey, Head of FX Analysis at Monex.

"Their main focus is on the fallout from Credit Suisse's demise and what this means for central bank policy".

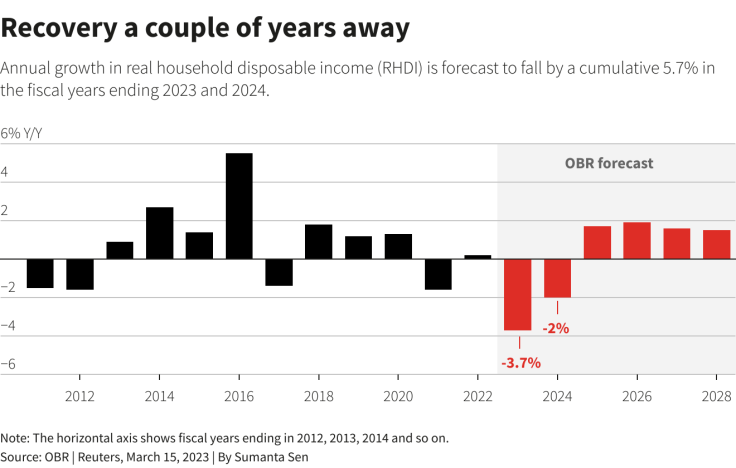

GRAPHIC - Recovery a couple of years away

STOCKS

Wider stock markets were trading negatively on Wednesday as focus remained on a deepening European bank rout. The FTSE 350 largely tracked other major indices and was last down 2.6%.

With corporation tax due to rise to 25%, there had been concern around the end of a generous pandemic-era tax saving on business investment known as the "super deduction".

Hunt announced a new incentive for business investment that will allow companies to offset 100% of their capital expenditure against profits, although that represented a scaling-back of tax breaks under a previous scheme.

Traders attributed a post-budget uptick in BT shares to the tax break on capital expenditure. Shares in the telecom company were last up 1.4%.

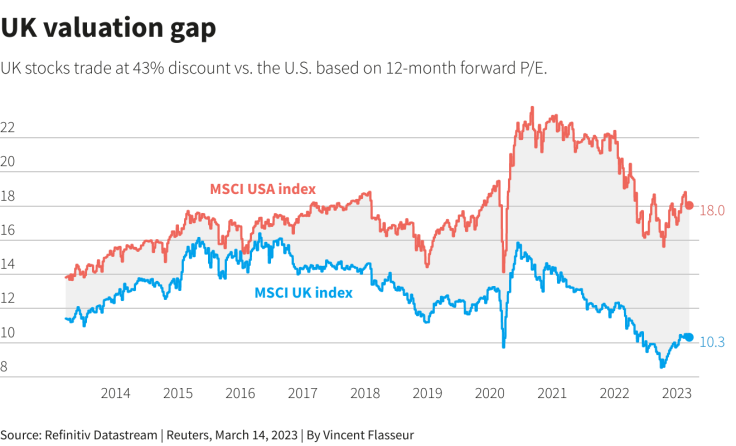

Such business-friendly moves are likely to be welcomed by market players who in the run up to the budget highlighted the wide valuation gap between UK and U.S. equities.

GRAPHIC - UK valuation gap

In light of Britain's support for Kyiv following Russia's invasion of Ukraine last year, another area of focus was defence spending, with the chancellor unveiling plans to add 11 billion pounds to the defence budget over the next five years

According to Michael Field, European Equity Strategist at Morningstar, the beneficiaries of increased defence spending include the likes of BAE systems < BAES.L>, Babcock < BAB.L>, Rolls-Royce and Serco < SRP.L>, but moves on the day were limited, as changes to defence spending had been flagged ahead of the budget.

Plans to extend energy bill subsidies for households is generally seen as a positive for energy companies, Field said.

Shares in British Gas owner Centrica tracked the rest of the market, down 2.6%, although shares in energy supplier SSE fared better, losing only 0.3%.

Unlike in the last budget, noise around windfall taxes on oil and gas companies was muted in the run-up to the budget since energy prices have fallen dramatically since then.

"If that inflation had lasted longer, the government would have been under pressure to take more action," said Field, adding that plans to boost nuclear power spending would be on energy majors' radar.

GILTS

The OBR now sees the economy contracting just 0.2% in 2023 versus previous forecast of a 1.4% contraction.

"The government is loosening policy so, all else being equal, that means demand should be stronger and rates might rise faster," said Martin Beck, chief economic adviser to the EY Item Club.

"However, the measures the government has brought in are mainly on the supply side, and to that extent should reduce inflationary pressure."

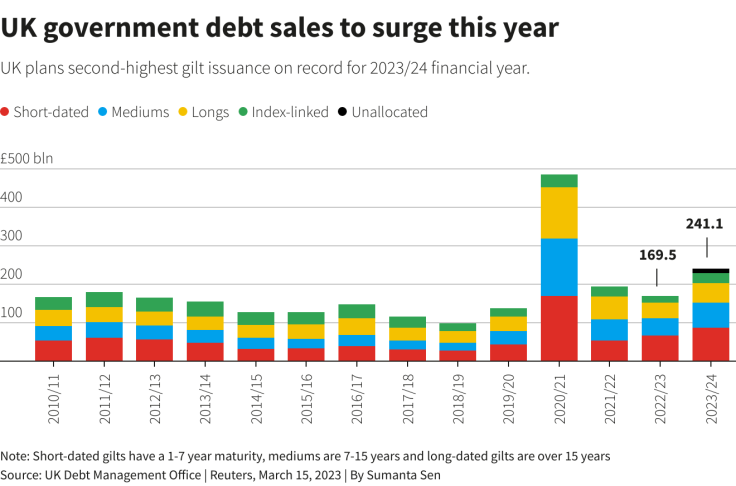

The Debt Management Office cut its plans for gilt issuance this year, with 241.1 billion pounds of borrowing expected, compared to 305.1 billion in November, but still above expectations in a Reuters poll of 232.5 billion.

"In general, the budget is not the big story for gilts right now, global drivers are in the driving seat," said James Smith, economist at ING.

"There's still a lot of supply for the market to absorb and that central challenge hasn't really changed."

GRAPHIC - UK government debt sales to surge this year

Copyright Thomson Reuters. All rights reserved.