UK consumer price inflation rate turns negative for first time since 1960s

The UK inflation rate turned negative for the first time since the 1960s, falling to -0.1% in the year to April, the Office for National Statistics said.

The fall was due to a slower rise in transportation prices and a 3% decline in food prices, it said.

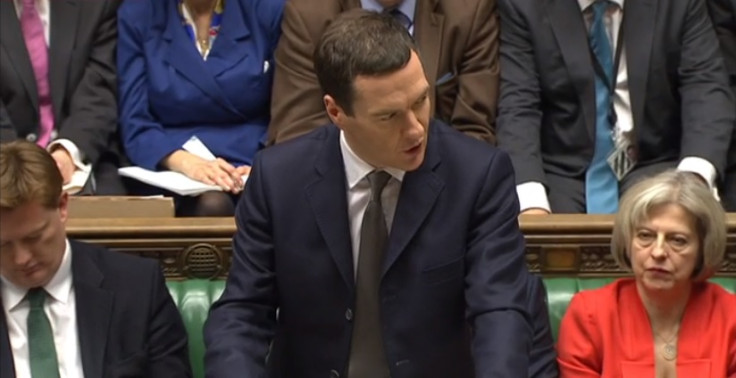

Chancellor George Osborne and some business leaders said its effect, however, poses no real threat to the UK economy.

"We should not mistake this for damaging deflation," the chancellor said. "Of course, we have to remain vigilant to deflationary risks and our system is well equipped to deal with them should they arise."

This is the first time inflation has turned negative since records began, but the ONS estimated that the last timed the UK saw a negative inflation was in March 1960.

In a report published on 13 May, the Bank of England's Monetary Policy Committee said the rate would return to the 2% target within the next two years. It was 0% in February.

The Institute of Directors also said the negative inflation rate announced today is "not even a distant threat in the UK".

The Confederation of British Industry added that inflation is expected to start rising again from the third quarter of this year, but will only reach 1.0% by the end of 2015 and little under the 2% target by the end of 2016.

"There is little to worry about from the UK's dip into mild deflation in April," a statement from the CBI said. "It should primarily have a beneficial impact on the economy through further boosting consumers' purchasing power."

Economists at research thinktank IHS Global added: "We suspect the UK could well exit deflation as soon as May, and we expect inflation to then hover around zero before starting to trend up gradually from the third quarter."

© Copyright IBTimes 2025. All rights reserved.