UK Government Hits Full Year Deficit Target but March Public Borrowing Rises - ONS

Britain's government met its austerity-driven deficit reduction targets for 2011/2012 year, according to Office for National Statistics (ONS) data, though public borrowing rose more than was predicted in the final month of the year.

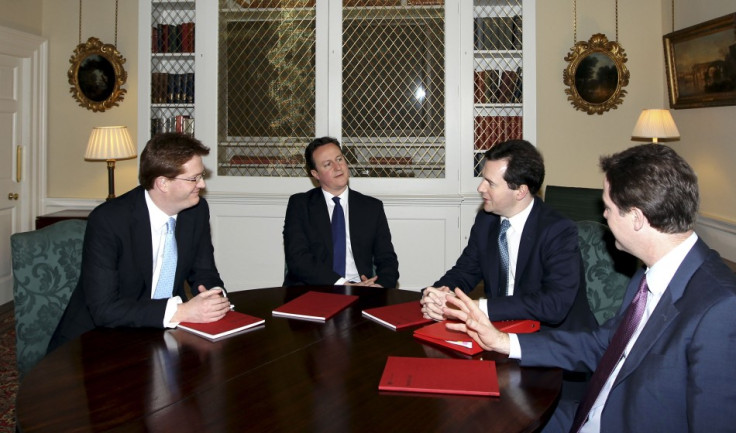

The Conservative-Liberal Democrat coalition has slashed public spending since taking office in May 2010 in its attempt to control public finances and get the deficit down.

However minimal growth, held back by a crisis-mired eurozone, slowing eonomic growth in China and high oil and commodity prices has not offset the drawback in public spending.

"March's public finance figures suggest that the trend in the UK's fiscal position is continuing to worsen," Samuel Tombs, Capital Markets analyst, told Reuters.

The budget deficit hit £11.1bn in March, excluding the temporary effects of financial interventions, meeting targets set by the independent public finances watchdog the Office for Budget Responsibility (OBR).

Net public borrowing hit £18.2bn in March, the highest for that month in two years and more than economists were forecasting.

This brought net public debt to £1.022tn - equivalent to 66 percent of GDP.

ONS figures on the UK's GDP growth were revised down from a -0.2 percent contraction in the last quarter of 2011 to a -0.3 percent.

This sparked renewed fears of a double-dip recession, should another quarterly contraction happen at the start of 2012.

These fears were eased by positive PMI data for the UK, which showed increasing activity in the services, construction, and manufacturing sectors in the first three months of the year.

OBR forecasts put UK GDP growth for 2012 at 0.8 percent, a slight improvement on the previous year's dismal 0.7 percent growth.

High inflation, which rose in March to 3.5 percent, rising energy bills, high unemployment, and dampened consumer confidence are all hurting the UK economy, along with global economic crsises elsewhere.

© Copyright IBTimes 2025. All rights reserved.