UK Jan Industrial Output Falls, Feb PPI Rises

British industrial output posted an unexpected fall in January after a sharp decline in oil and gas production and weaker-than-expected factory output, indicating that Britain's economic recovery could be in peril.

According to the latest figures released by Office for National Statistics, the seasonally adjusted Index of Production fell by 3.8 per cent in January 2012 compared with January 2011 and fell by 0.4 per cent between December 2011 and January 2012. The seasonally adjusted Index of Manufacturing rose by 0.3 per cent in January 2012 compared with January 2011 and rose by 0.1 per cent between December 2011 and January 2012.

"On the negative side, in terms of talking negative rates, you've got the Bank of England's forecast inflation expectation survey which is down by more than half a percent, which is good news, you also have industrial production which is a bit weaker, bad news for the economy but obviously in terms of rates on the negative side. The big concern here is input prices and output prices which rose substantially more than expected, and I think that does sort of raise a risk to inflation, but at least it's being offset by the fact that CPI expectations have come down a bit," says George Buckley from Deutsche Bank.

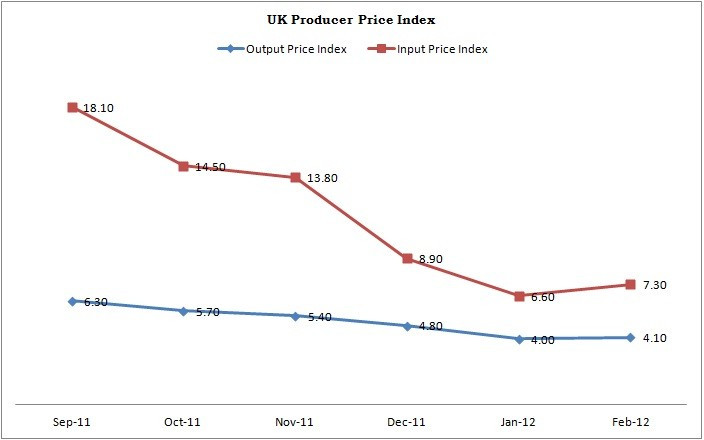

In the year to February 2012, the output price index for home sales of manufactured products rose 4.1 per cent, compared with a rise of 4.0 per cent previous month and between January and February it rose 0.6 per cent. This is the largest monthly increase since April 2011, when the index rose 1.1 per cent. The output price index excluding food, beverages, tobacco and petroleum rose 3.0 per cent, compared with a rise of 2.4 per cent last month.

While the total input price index rose 7.3 per cent for the year to February 2012 , compared with a rise of 6.6 per cent last month, between January and February the index rose 2.1 per cent.

While commenting on numbers, Samuel Tombs from Capital Economics told Reuters: "Today's disappointing industrial figures provide further evidence to suggest that the manufacturing recovery is already starting to lose steam... We struggle to see how producers will manage to keep pushing through price increases if demand remains this weak. Note too that the Bank of England's Inflation Attitudes Survey for Q1 revealed a decent drop in households' inflation expectations for the year ahead. So as things stand, the recent increase in oil prices still seems unlikely to prevent CPI inflation from falling to a very low rate later this year."

© Copyright IBTimes 2025. All rights reserved.