USD/CAD Rises to One-Week High Despite Broad Dollar Weakness Ahead of Canadian Jobs Data

The Canadian dollar continued to fall against the US dollar on Tuesday despite the greenback's broad weakness, suggesting the loonie needs stronger positives for rallying beyond the six-month high touched on 3 July. The market is waiting for Friday's employment data.

Last week's GDP data was on the negative side with the April monthly growth coming at 0.1%, unchanged from March, but below the consensus estimate of 0.2%.

USD/CAD had been trading higher since 3 July in spite of the better than expected trade and building permits data released since then.

Canada's May mercantile trade deficit came in at $0.15 billion while the market had been expecting a gap of $0.30 billion. Building permits in Canada rose 13.8% month-on-month in May versus the April growth of 2.2% and analysts' expectations of 3.0%.

At the same time, the sharp drop in the Ivey purchasing manager's index kept the Canadian currency southbound.

The seasonally adjusted Ivey PMI fell to 46.9 in June from 48.2 in May and against the consensus estimate of 52.5, data showed on 7 July.

USD/CAD traded as high as 1.0695 on 8 July, a one-week high, from the previous close of 1.0684. The pair has strengthened more than 0.7% from 3 July.

Data Busy Week

The week to 11 July is an important one for the Canadian dollar with the unemployment numbers due on Friday. The market consensus is for an addition of 26,200 jobs for June higher than 25,800 in the previous month. The unemployment rate is seen steady at 7%.

Data on Wednesday may show the number of housing starts in May to have increased 191,000 on year lower than an increase of 191,800 in April. The new housing price index for May on Thursday is the other housing market data scheduled for the week.

The Broad Trend

The Canadian dollar has been trending higher after regaining ground from a near five-year low of 1.1280 it touched in mid-March.

Dovish remarks at the 18 June FOMC helped the pair to break below the 1.0813 support, pushing it down more than 2% by the 7 July low of 1.062 that matched the 31 December 2013 level of 1.0623.

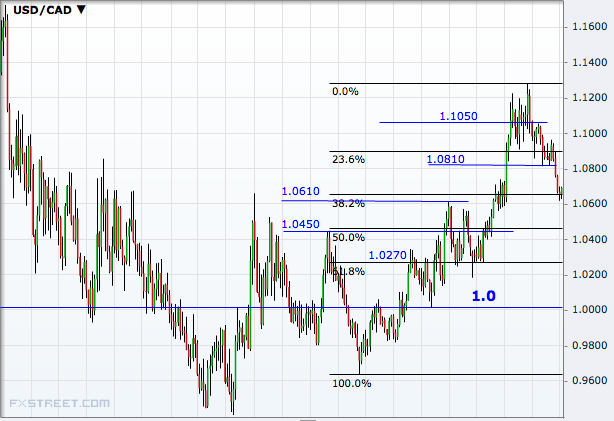

Overall, the Canadian dollar has reversed its entire losses of the first three months of 2014 and is now stuck to key Fibonacci retracement levels.

The 18 June FOMC pushed USD/CAD through the 23.6% retracement of the September 2012 to March 2014 rally and the pair is now testing the 38.2% level of 1.0610.

A break of that will open doors to 1.0450, the 50% level and then the 61.8% mark of 1.0270 ahead of the psychologically important 1.0.

On the higher side, the 23.6% level of 1.0810 has now turned a strong resistance. After that 1.1050 is a level to watch ahead of the retest of the 20 March peak of 1.1280.

© Copyright IBTimes 2025. All rights reserved.