Vatican Bank to Act on Iran Money Laundering Fears

The Vatican bank, the Institute for Religious Works (IOR), is on the cusp of closing all foreign embassy accounts after missions from Iran, Iraq and Indonesia raised money laundering concerns about large cash deposits and withdrawals.

According to unnamed sources, the IOR is likely to enforce the shutdown after the Vatican regulator signed an information-sharing pact with a US agency that tracks suspicious financial transactions. That put pressure on the world's smallest country to clean up its financial act.

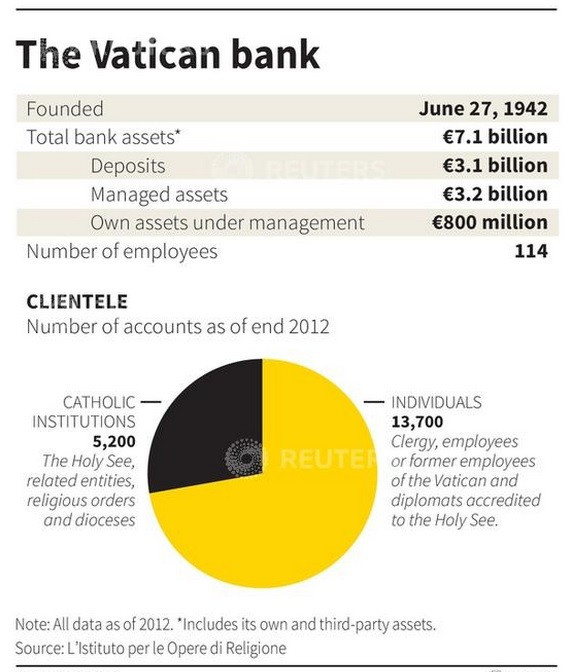

The IOR is the world's most secretive bank and holds €7.1bn in assets under management (AuM).

While it says its goal was to hold and manage funds for religious orders, Catholic charities, Vatican employees and other Catholic institutions, the number of account holders has soared to 19,000.

There are 24 countries that have accounts in the private bank [Fig 1]. The US and UK are not among them.

In April 2011, the Vatican created the Financial Intelligence Authority to collect and exchange information on suspicious transactions with the US Financial Crimes Enforcement Network (FinCEN), a unit within the US Treasury Department.

Italian magistrates revealed that they have been investigating the IOR for money laundering. The IOR declined to comment "on actual or rumored client relationships".

However, it emphasised that as of year-end 2012, 5,200 Catholic institutions accounted for more than 85% of AuM and13,700 individuals (clerics, employees or former employees of the Vatican with salary and pension accounts and diplomats accredited to the Holy See) accounted for around 15% of AuM.

"The IOR is undergoing an outside review by Promontory Financial Group of all client relationships and the anti-money-laundering procedures it has in place. In parallel, the institute is implementing appropriate improvements to its structures and procedures," said the IOR.

"This process was initiated in May 2013 and is expected to be largely concluded by the end of 2013."

'Refurbishment' Costs

Substantial deposits and cash withdrawals have raised eyebrows amongst regulators.

The city's financial watchdog said it believed that the justification by the embassies of Iraq, Iran and Indonesia for the transactions, which were examined in 2011, were too vague or disproportionate to the amounts.

Some transactions were deposited or withdrawn at €500,000 a time. One reasong given for a transaction was "refurbishment" costs.

Vatican City has ramped up attempts to root out financial scandal and become more transparent since 2010.

In addition to the signing of the pact with the US agency, it has also pledged to be more forthcoming with information and has created a website to share that information.

The pledge of transparency suffered a setback when Rome magistrates, investigating money laundering allegations, froze €23m held by the IOR in two Italian banks.

The IOR said it had been transferring its own funds between accounts in other countries.

The accounts were unfrozen after IOR officials told Italian magistrates that the money would be used to buy German securities but the investigation continues.

© Copyright IBTimes 2025. All rights reserved.