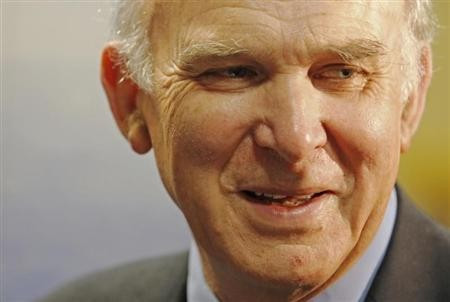

Mis-Selling Derivatives to SMEs: Vince Cable says Scandal is 'Tip of Iceberg'

The mis-selling of derivatives by Britain's biggest banks is only the 'tip of the iceberg' and parliament is working on a number of sub-issues to get justice for small-to-medium business owners, says UK business secretary Vince Cable.

Speaking exclusively to IBTimes UK on the phone, Cable says that politicians are working intensively on a number of issues surrounding the scandal, in order to stop other businesses being driven into bankruptcy by crippling interest rate swap agreement (IRSA) payments.

"This is an enormous problem and this is only the tip of the iceberg, but parliament is working on a number of other issues arising from this, in order to help out as many businesses as we can," said Cable.

"We are now working on unresolved issues surrounding the mis-selling scandal, including how businesses have been forced to close because of the products the banks sold in the first place.

"This includes deciphering who will be able to help the businesses in administration, when their assets have been taken away from them, and who will be in charge of finding a solution for them. This hasn't been done before."

Interest rate swap agreements - or IRSAs- are contracts between a bank and its customer where typically one side pays a floating, or variable, rate of interest and receives a fixed rate of interest payments in exchange. They are used to hedge against extreme movements in market interest rates over a given period.

Companies that have seen the value of these products move against them as rates fell during the recession now owe banks crippling sums of money in interest payments each year.

But if the businesses want to cancel the contracts, they are faced with higher costs.

At the end of June 2012, the FSA, now renamed the Financial Conduct Authority, released its findings from a review that found that 40,000 IRSAs had been sold to customers.

All cases will be investigated for potential mis-selling.

In its agreement with the banks, the FSA banned HSBC, Barclays, Lloyds and RBS from selling interest rate swaps to SMEs.

At the end of January this year, the FSA then unveiled its findings from a pilot scheme that examined the sale of 173 IRSAs to British firms and found that at least 90% of those did not comply with at least one or more regulatory requirements.

While the banks have been pressed to determine and deliver offers to customers under the Pilot Scheme, thousands of other people who were sold these products are still awaiting a determination.

After speaking to many people close to the situation and banks, IBTimes UK has found that progress at each institution is moving at different speeds.

"We need to prompt the banks continually to speed up results but it's worth nothing that each case is very complex," said Cable.

At the beginning of this month, IBTimes UK launched a special video investigation into the murky world of administration, where we talked to businesses and experts about being in limbo, after being tipped over the edge into insolvency.

© Copyright IBTimes 2025. All rights reserved.