Why Scottish Independence Will Hurt the UK General Election 2015, Banking and Scotch Whisky

Scottish independence would not only have a significant impact over Britain's general election in 2015 but it could also hurt Scotland's businesses, banking system and even the Scotch whisky industry, says Bank of America Merrill Lynch.

According to Bank of America Merrill Lynch, the uncertainty and unlikelihood over an independent Scotland retaining the pound, as well as its membership to the European Union (EU), would create a ripple effect across all industries and lead to problems in infrastructure in the short to medium term.

"Under independence, the Scottish Government's currently stated preferred option is to continue using Sterling in a formal currency union with the remaining UK," said BAML in its European Research report, entitled What if Scotland Votes for Independence?

"But all of the main UK political parties have thus far stated that they would not agree to Scotland retaining Sterling. Thus, we believe future currency arrangements - what and who Sterling would represent, the Bank of England's role as central bank and lender of last resort, and redenomination risks/capital flows - are at the heart of uncertainties around Scottish independence, and could impact upon a range of financial assets."

Scottish people will vote in an independence referendum on 18 September this year and will be asked the straight "yes/no" question: "Should Scotland be an independent country?"

The referendum period started on 30 May.

Banking Risks

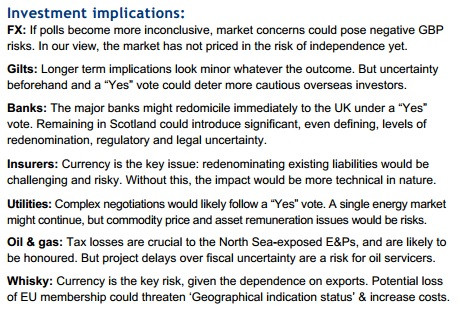

BAML highlighted in its report that a vote for 'Yes' will immediately impact a whole host of industries, ranging from banking and insurance, to oil and Scotch whisky [Figure 1].

It said that banks currently domiciled in the country, such as the Royal Bank of Scotland (RBS), would be exposed to a wide range of complex risks in the event of a 'yes' vote, under their current structures.

"One potential result of a yes vote could be an immediate re-domiciling of the parent companies and relevant holding and operating companies to England," said BAML.

"Scottish operations of RBS and Lloyds are relatively small (well below 10% of total assets) so introducing exposure to redenomination, regulatory, tax and legal issues to fundamentally non-Scottish balance sheets by remaining Scottish registered companies could trigger significant pressure on management to consider re-domiciliation of the company.

"While domestic operations could potentially be housed within Scottish entities, we think there would be significant practical, operational and branding issues to continuing with Scottish domiciliation at the parent level."

Banks and financial firms have already revealed that they are already looking to move operations elsewhere, should Scots vote for independence. Britain's business secretary, Vince Cable, has also warned that RBS will most likely be headquartered in London, if Scotland does break away from the rest of the UK.

Scotch Whisky

While the report goes into depth about the detrimental impact independence could have on a range of industries in Scotland, BAML outlined how the jewel in the country's crown, Scotch whisky, could be hit the hardest.

Scotch whisky, by its definition, must be distilled and matured in Scotland. Diageo and Pernod Ricard are the two largest producers accounting for around 55% of global volumes sold in 2013.

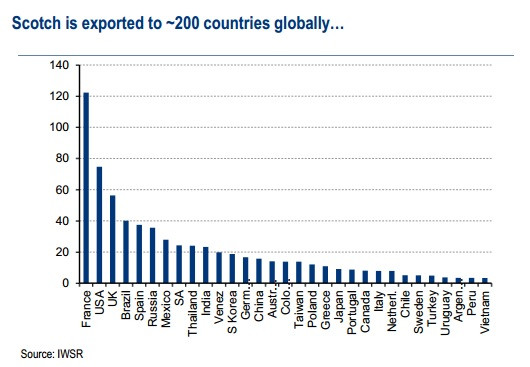

According to BAML, Scotch whisky is Scotland's second largest export industry after oil & gas and is exported to approximately 200 countries, with non-UK markets accounting for 92% of volumes sold [Figure 2].

The Scotch Whisky Association estimates that scotch exports contributed £4.3bn (€5.3bn, $7.2bn) to the United Kingdom balance of trade and supported around 35,000 jobs in 2013.

The industry is also committed to investing £2bn over the next two years, added BAML.

Pegged on the fact that an independent Scotland could lose the pound and trade ties associated with being part of the EU, the country could face greater currency volatility as well as missing out on free trade opportunities under the 28-nation bloc.

On top of that, BAML warns that as a major exporter, the scotch whisky industry currently benefits from access to the UK's "extensive network of overseas embassies, agencies and trade delegations."

"At the present the Scottish Government's white paper on independence is proposing a network of 70-90 overseas missions vs. the 200 markets that scotch is currently exported to. An independent Scotland may also likely have less influence to exercise on behalf of business than the larger UK.

"Scotch whisky enjoys the protection of 'geographical indication status' under EU law. This protected status could therefore be put at risk leaving the industry exposed to greater overseas competition/private label brands and reversing the progress that industry has made in tackling counterfeit products," it adds.

General Election 2015

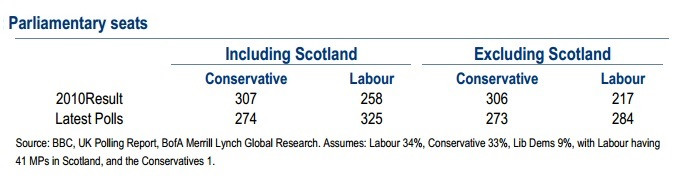

Overall, BAML warns that an independent Scotland could throw a major spanner in the works for Britain's 2015 general election as Westminster is under-prepared for a union break [Figure 3].

"Scotland leaving the UK could potentially impact Parliament in Westminster significantly. Not least, given the lack of Parliamentary preparation for an independent Scotland, there could be issues around how the 2015 UK general election would be conducted: i.e., with or without the Scottish Parliamentary seats," said BAML.

"If the Scottish seats were excluded, the Conservatives would have won the 2010 general election alone. Looking ahead, if voting intentions were unchanged, the Labour party might lose around 40 seats without Scotland, and opinion polls would suggest material risks of a hung parliament."

© Copyright IBTimes 2025. All rights reserved.