Yen Plunges to New Six-Year Low vs Canadian Dollar Amid Mixed Data

The Japanese yen plunged to a new six-year low against the Canadian dollar on Wednesday amid mixed data from Japan and with the Canadian dollar remains supported by the stronger than expected jobs data on Friday.

CAD/JPY rallied to 102.31, its highest since September 2008. The cross then eased to 101.67 but at that level, the yen was down 1.9% so far on the month against its Canadian counterpart.

The Japanese yen has been steadily declining against the loonie from mid-October and has weakened more than 8% since then.

A rise in the Japanese stock markets, tracking the US stocks rally overnight, also weighed on the yen.

An index measuring the household confidence of Japan fell to 38.9 for October from 39.9 in the previous month, against the consensus of a rise to 40.6. At the same time, tertiary industry activity index made a rebound to 1.0% from the -0.1% reading of September, data shoed on 12 November.

Slightly hawkish comments by the Bank of Japan board member Ryuzo Miyao on Wednesday too did not prevent the yen's decline against the Canadian unit, though the remarks aided a drop in USD/JPY.

Miyao said that the central bank could start talking about an exit from ultra-loose monetary policy around the second half of fiscal 2015 if, as expected, inflation nears a sustained 2% level.

"As a result of this measure, I think we can comfortably achieve a balanced 2% inflation that comes with improved corporate profits, employment and wages," he said, and added that he expects consumer prices to pick up the pace of increase next summer as the base effect of the recent slump in crude oil prices fades.

The Nikkei 225 rallied more than 1.5%, adding to a 2.1% gain on Tuesday's as investors speculated that the government might delay a planned sales tax increase in response to a steadily worsening fiscal situation.

As per data on Friday, Canada's unemployment rate has fallen to a 6-year low of 6.5% in October. The release on Friday was a positive surprise as analysts were expecting no change from the September reading of 6.8%.

The market will now wait for the industrial output data from Japan and new housing price index data from Canada - both for September - due on Thursday.

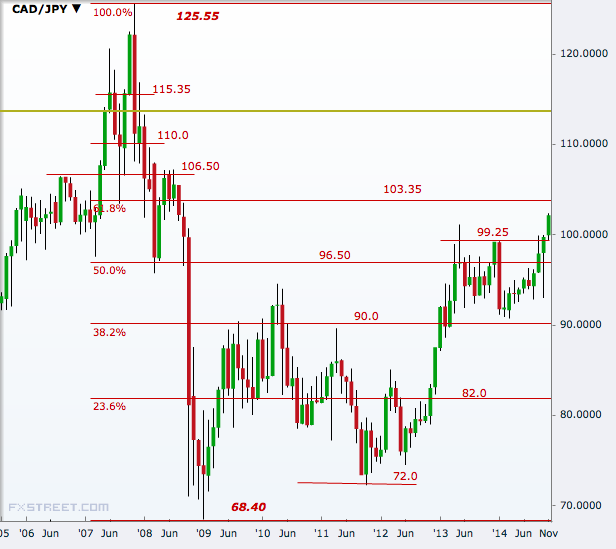

CAD/JPY Technical Analysis

For about the past two months, the cross has been holding above the 50% Fibonacci retracement of the 2008-2009 selloff but the break above the 100-mark this month has made it well positioned for a move above the 61.8% mark 103.35, which is just 1 yen away now.

Analysis of the monthly chart shows that as long as 90 is held, the cross stands biased upward, and therefore, a break of 103.35 will open doors to levels near 110.

On the downside, 99.25 and 96.50 are the two levels to watch before the very important 90-mark.

© Copyright IBTimes 2025. All rights reserved.