5 Ways to Use Appointment Scheduling in Banking

Banking scheduling refers to systems and tools that allow customers to book appointments for specific services

Are you tired of waiting in endless lines at the bank, wasting hours you'll never get back? The inefficiencies in traditional banking systems don't just inconvenience clients; they also hurt banks financially and erode customer trust.

The importance of queue management is rooted in its capacity to resolve these challenges efficiently.

Longer wait times and disorganised processes frustrate customers, affecting the bank's bottom line. Thankfully, today's modern business scheduling tools make it much more efficient, with shorter wait times and the personal touch people have come to expect.

Let's explore how these solutions are transforming the banking experience.

What is Banking Scheduling?

Banking scheduling refers to systems and tools that allow customers to book appointments for specific services. It's more than just a convenience; it's a game plan to improve satisfaction, boost productivity, and eliminate service delays.

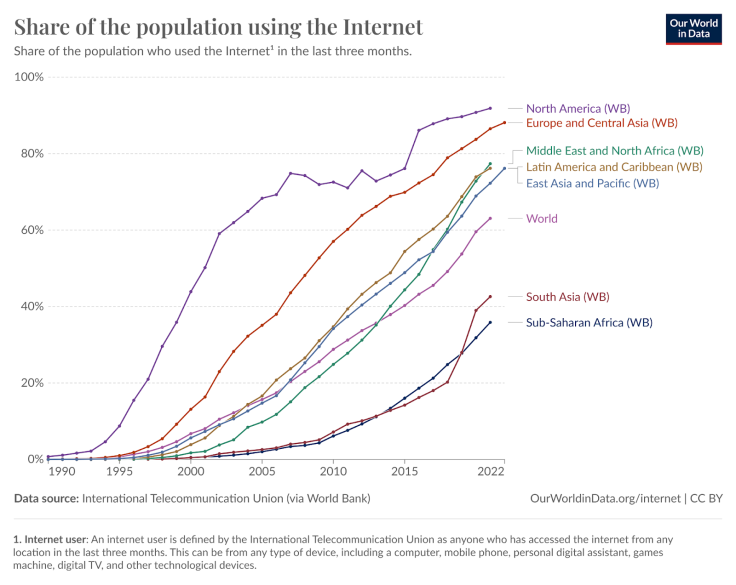

The importance of queue management becomes even more evident in today's digital age. Adoption trends for internet use across regions show that technology has become an integral part of daily life, with rapid growth over the past two decades.

For example:

- Over 80% of the population in North America and Europe is online.

- Regions like South Asia and Sub-Saharan Africa are quickly catching up.

Such changes mirror digital transformational innovation, such as banking appointment scheduling software. These tools streamline operations, minimise wait times, and provide customers with seamless access to services, enabling their respective organisations to enhance operations in their respective industries and exhibit the capabilities of new technologies reshaping industries across the globe.

Tools like appointment scheduling software for banking are explicitly developed for the financial sector. They help banks manage the soaring appointment volume while delivering outstanding service quality.

5 Game-Changing Applications of Bank Appointment Scheduling Software

Modern appointment scheduling software streamlines banking operations and enhances customer experiences. Here are five key ways in which it's changing the industry.

1. Seamless New Bank Account Openings

Opening a new bank account can feel like a chore, but it doesn't have to be. Scheduling tools like those offered by Q-nomy make the process fast and hassle-free. Customers can:

- Book a convenient time to meet with a representative.

- Upload required documents beforehand for faster processing.

- Receive reminders to avoid missed appointments.

This approach saves time and enhances satisfaction, aligning with the broader technological shift that is driving efficiency in financial services.

2. Enhanced Wealth Management and Pension Planning

Maintaining finances is essential for high net-worth people — especially when retired. Banks use appointment scheduling systems to match customers to suitable advisors so that every session is productive and specific. For example:

- Advisors can prepare personalised plans in advance.

- Clients enjoy undivided attention for meaningful discussions.

- Banks track appointment trends to identify high-demand services.

3. Simplified Mortgage and Home Loan Consultations

Clients often find the loan process to be overwhelming. Banking appointment scheduling software simplifies the experience by:

- Automating document collection.

- Providing virtual consultation options for remote clients.

- Providing step-by-step guidance during the application process.

These tools make loans less frightening and easier to manage, and clients remain supported throughout the process.

4. Streamlined Insurance Services

From life insurance to auto policies, customers value quick and efficient service. Scheduling systems play a vital role by:

- Matching customers with specialised agents.

- Enabling quick follow-ups for claims or renewals.

- Reducing wait times during peak periods.

5. Resolving Account Issues with Ease

Account problems are stressful, but addressing them promptly can ease frustrations. Scheduling software ensures quick resolutions by:

- Letting customers book slots directly with problem-resolution experts.

- Providing clear timeframes for resolutions.

- Reducing repeat visits with targeted solutions.

A study by The Banker revealed that 58% of consumers prefer interacting with their bank online, and 38% check their banking app daily. Digital appointment systems meet these preferences while streamlining issue resolution and enhancing efficiency and satisfaction.

Key Benefits of Banking Scheduling Systems

Here's a summary of the advantages of incorporating scheduling tools in banking:

| Benefit | Description |

| Improved Efficiency | Staff are better utilized with clear schedules. |

| Enhanced Customer Service | Personalized attention improves client satisfaction. |

| Reduced Wait Times | Scheduling tools minimize queues and create a smoother experience. |

| Data-Driven Insights | Appointment trends help identify opportunities for improvement. |

These benefits show why queue management is vital as banks embrace customer-centric solutions

In Conclusion

As queue management becomes more critical, banks must adopt modern solutions to stay competitive. Banking appointment scheduling software addresses challenges like long wait times and inefficient processes. These tools are indispensable for delivering exceptional service, from opening new accounts to resolving complex issues.

Queue management reduces wait times, creates seamless customer experiences, and optimises staff productivity. Modern tools like Q-nomy offer banks tailored solutions to meet these goals, transforming operations and enhancing satisfaction.

Alex Rivers is a contributing gaming and casino writer with a passion for exploring industry trends, game strategies, and insider tips.

© Copyright IBTimes 2025. All rights reserved.