Nicholas Charles on Breaking the Generational Wealth Curse: Why 90% of Families Lose It All—and How to Stop the Cycle

Generational wealth isn't just about taxes and financial assets but about transferring knowledge, expertise, and guidance

Seven in ten families lose their fortune by the second generation, and this number increases to 90% by the third. With $85 trillion set to transfer to the next generation in the coming two decades, this impending wealth transition (or loss) highlights a critical issue that Nicholas Charles (FCCA), founder of the legacy planning platform Danti, is determined to address.

For Nicholas, generational wealth isn't just about taxes and financial assets but about transferring knowledge, expertise, and guidance. His life story reveals the profoundly human and deeply emotional side of the challenge of mixing money with family affairs.

Growing up in a family that lost its fortunes within a generation, he witnessed first hand how wealth without proper stewardship can become a source of pain and fear rather than prosperity. His great-grandfather, a self-made multimillionaire from Cyprus, left behind a significant financial legacy to his only son— Nicholas' grandfather— only for it all to be squandered due to family disputes and poor management.

By the time his father turned eight, the family's wealth had dissipated, forcing him to start over from scratch. Instead of enjoying third-generation wealth, he had to reset the wealth cycle, beginning work on a farm at a young age.

When his father recounted this tale to a 14-year-old Nicholas, it planted a seed in his mind that would eventually inspire the founding of Danti. He realised that wealth transfer was about more than money; it was about values, preparation, and governance.

'It was a compelling story that my father told me. For the next few decades, I believed I was destined to lose everything just like my grandfather had, and I was determined not to end up that way,' he reflects.

Twenty years later, Nicholas had built a career as a respected accountant, tax advisor, property advisor, and real estate investor. One day, a wealthy client approached him for his forensic accounting services, and the true scope of the loss of generational wealth became clear. The client's immense wealth was at risk due to— once again— family conflict and mismanagement, leading to seven years of ugly, costly litigation against her only sibling.

'As you can imagine, once you go to court with a family member, that relationship is dead on impact; it's finished. No parent wants their legacy to be their children ending up in court,' he adds. This experience was a pivotal moment for Nicholas; it inspired him to explore the psychology of wealth and its impact on families more closely.

Over the next two years, Nicholas researched generational wealth extensively, including interviewing over a hundred advisors, from private bankers and wealth managers to fiduciaries and lawyers.

This culminated in writing two books, The Four Fundamentals of Family Prosperity, and its follow-up in 2022, Generational Wealth, which soared to a number-one finance bestseller on Amazon. These works explore the root causes of families failing to sustain their wealth and emphasise the importance of transferring all the wealth to the next generation, not just the financial capital.

Nicholas says, 'After my career advising families and writing books on the same, I wondered where I could take it from here. Although I love consulting, I could only reach so many people through it, but generational wealth management is a global problem, that needed massive outreach.'

In 2023, Nicholas teamed up with his long-time friend, tech entrepreneur, and Y Combinator Alumni to develop Danti, a cutting-edge operating system designed to help families navigate the complexities of wealth management. After sixteen months of fine-tuning, Danti was launched for family offices worldwide in December 2024.

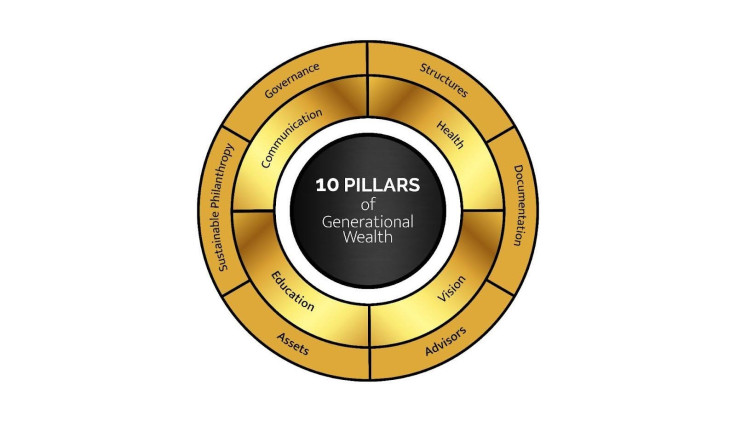

With a private, secure, and confidential network for each family, Danti enables family offices to plan generational wealth with certainty and a focus on love rather than competition. The digital platform also facilitates the future growth of financial assets, pathways to philanthropy, and effective communication within the family tree. Danti simplifies the process, reduces costs, and focuses on the ten pillars of generational wealth, which include vision, health, education, and communication, which are the foundation of building sustainable legacies.

'There's a saying in this business: 'If you've seen one family office, then you've only ever seen one family office." That's because every family is unique. However, what everyone is ultimately trying to achieve with their wealth is to create a legacy from it. And to do that, you have to work on the business of being a family,' Nicholas explains,

'Death is hard to talk about, but it's inevitable. You need to have something in place for the next generation, whoever that may be, to take over your legacy. Because your legacy is not you, it's not your money, it's the people you leave behind. If you don't prepare them for it, you're doing a disservice to yourself, your work, and your family.'

This is, in essence, the driving force behind the launch of Danti and Nicholas' life's work. He emphasises the importance of seeing the bigger picture in life instead of inevitably devolving into the struggles of infighting over family wealth.

'There's no point in waiting till you're on your deathbed. You need to guide them now; you need to be present now.'

In the coming year, Danti is set to expand its functionality with an education module aimed at preparing the next generation to manage wealth responsibly by considering all the aspects of capital— financial, human, intellectual, and social.

As time has repeatedly proven, leaving wealth to an unprepared heir is a gateway to destructive behaviour. In response, the Danti team is developing an all-encompassing process to record the wisdom of current generations and pass it on to the next.

'All their stories, histories, experiences, good and bad, is vital information to be stored and saved for future generations. Because that is an incredible wealth,' Nicholas adds.

Nicholas is also working on his third book, The Ten Pillars of Generational Wealth, which is scheduled for release in June 2025. With this work, he aims to shift the narrative around wealth planning from tax strategies and legal frameworks to a more comprehensive approach that prioritises family unity and purpose.

'Everyone wants to live their unique journey towards happiness, whatever that may be. What we need to do as families is to love our children without condition and help facilitate their journey,' Nicholas concludes. With Danti, Nicholas Charles' mission to transform the world one family at a time is well underway.

© Copyright IBTimes 2025. All rights reserved.