'Do I Pay for My Daughter's Ear Infection or Food': Manager Had $34K Student Debt, Now It's Over $500K

Millions At Risk of Defaulting on Student Loans

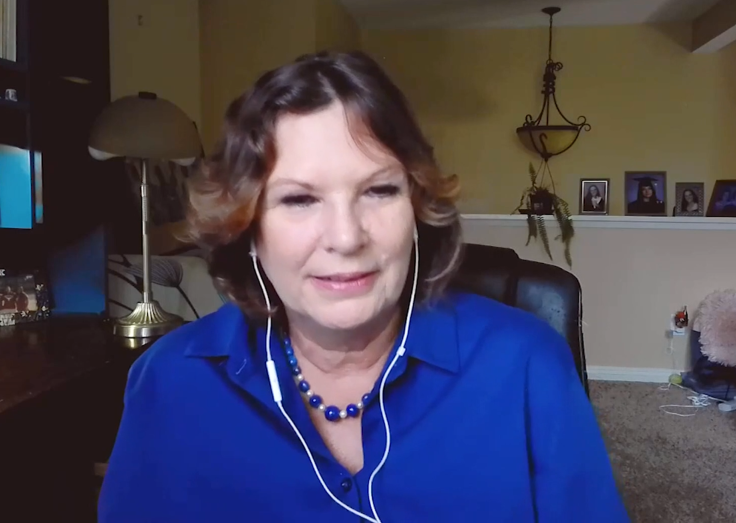

As a senior manager at a pharmaceutical firm, Angela Bolt's student loans began at $34,000, but have grown to an overwhelming $528,152 over the years. In a BBC interview, she expressed her disbelief, saying, "The numbers are so real and astronomical that I can't even fathom making a payment."

As of early 2023, Bolt's monthly payment was $5,698.30. She remarked, "That's basically almost what I make...There's no way I'll be able to make payments in my life. The kind of payments they want."

Despite receiving multiple scholarships and grants, she found that they only covered some things. "There were times when I had to choose between getting money to pay for my daughter's ear infection or buying food for us," Bolt added.

As a single parent, Bolt's only hope is that she ceases to exist before the student loans are due because she cannot afford to pay them and still sustain a household. The Education Data Initiative has highlighted the steady rise in US student loan balances, which reached $1.727 trillion in 2023 from $520 billion in 2006. Bolt's pain and dimming hope of repaying existing loans in a lifetime are becoming common across states.

The US government estimates that around 40% of student loan borrowers defaulted on their October 2023 payments after the pandemic-era freeze on student debt repayments ended. The high cost of borrowing due to elevated inflation, slow wage growth, and market uncertainty continue to impact the regular lifestyles of student loan borrowers.

Associate Director Pays Back Nearly Double of Original Loan, Still Owes $99,000

Tereina Stidd, associate director of education at the American Academy of Estate Planning Attorneys, finally brought her student loan balance to under $100,000 after paying back $186,000 in federal loans. That's almost twice what she originally borrowed. "Student loans have been a noose around my neck for 20 years," she said. "If I had the ability to talk to my younger self, I would have never ever gone for that law degree."

Stidd grew up in foster care and lost her mother when she was 13 years old. She also received many scholarships and felt empowered to finance that education. Now, with children and mortgage payments, she is determined to impart what she has learned to her kids so they don't get "stuck in the same cycle."

Parents teaching kids about finance early on is a trend that picked up pace after the pandemic. According to a 2022 survey, 83% of US adults believed parents should work on their kids' financial literacy. "Every child's very first teacher is their parent," said Yanely Espinal, director of educational outreach at Next Gen Personal Finance. "This means early money lessons in the home are critical."

Doctor's Debt Ballooned From $225,000 To $355,000 in 10 Years

Minnesota University Assistant Professor of Infectious Diseases, Matthew Pullen, has been paying for nine out of the last ten years for a loan that was initially between $225,000 and $250,000. It grew to over $350,000, where monthly payments were $1,317.26. Pullen refuted the idea that doctors always do well. "I still drive a 10-year-old car that I bought in residency," Pullen said. "It is almost like a paradox of what people imagine doctors take in as income and they actually live."

He cannot imagine buying a house, making mortgage or property tax payments, and keeping up with maintenance costs. A TransUnion and Boston Consulting Group study suggested that 1.4 million people are at risk of defaulting on at least credit products over the next 12 months.

President Biden Ramps Up Relief

The US government has made further progress with its student loan relief programs. It recently approved canceling $7.4 billion in student loans for over 277,000 people. The Biden Administration has approved $146 billion in student debt relief for 4 million Americans over two dozen executive orders to date. However, as elections near, uncertainty remains around the continued effectiveness and continuity of these programs.

© Copyright IBTimes 2025. All rights reserved.