Edmund Shing: As FTSE 100 hits all-time highs, it's time to take advantage of stocks and shares

Stock market indices worldwide have been crashing through key psychological levels to new all-time highs: 7,000 on the FTSE 100, 5,000 on the technology-heavy Nasdaq index in the US and 12,000 on the key DAX index in Germany.

But most people have missed out on this market rally

While this stock market rally sounds very glamorous, one of the key features of the current run-up in stock markets worldwide is how few people in Europe have actually taken advantage.

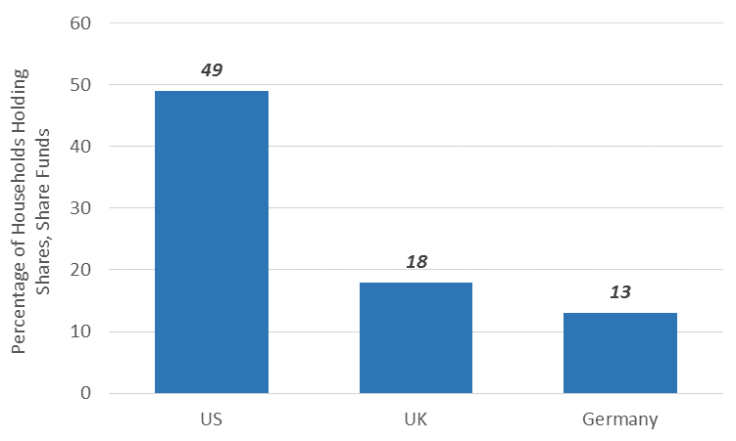

Take the example of the UK: only 18% of households hold exposure to shares directly or indirectly via unit trusts or other funds (Figure 1). That means 82% of households have seen no direct benefit from the doubling in value of the FTSE 100 index since the early 2009 crisis lows.

In fact, matters are even worse in Germany, where only 13% of all households had any exposure to shares or equity funds of any sort.

And you may think the doubling in value of the FTSE 100 over six years is impressive. Well think again. The German DAX index of Germany's largest 30 stocks has risen from 3,600 in early 2009 (a similar level to the FTSE back then) to over 12,000 today, more than tripling in value over the same six years.

The 2008-09 financial crisis took its toll on stock market confidence

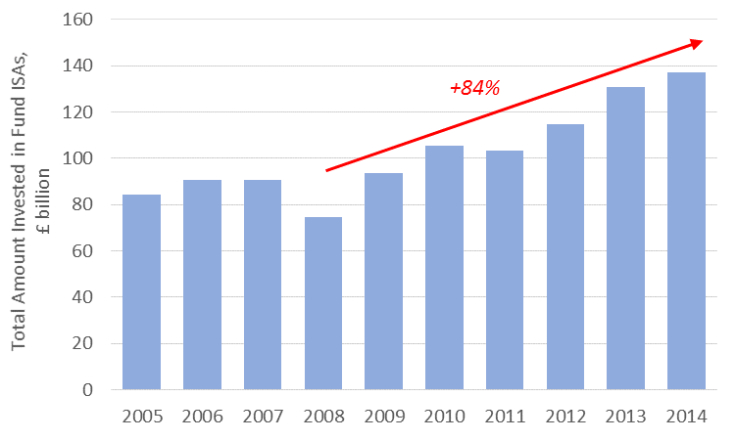

Clearly, the big hit to stock markets from the 2008 global financial crisis (when the FTSE 100 fell nearly 50%) has put many people off investing in stocks and shares, as we can see from the drop in value of unit trusts held in Isas from 2005 to 2008 (Figure 2).

Interestingly, the total value of funds held in Isas only rose 84% from the low in 2008 to the end of 2014, while the FTSE 100 doubled. Clearly, a lot of the money held in funds in Isas was not invested in shares but rather in other assets such as government bonds.

Yet again, more evidence that many investors have not taken full advantage of the current stock market rally.

Mostly about housing

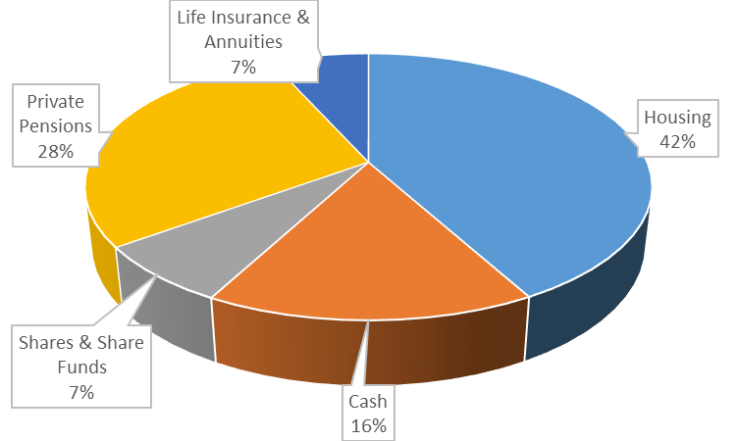

So where is the net worth of UK households held? Unsurprisingly, given the strong rebound in the UK property market over the past few years, 42% is held in housing (both primary residences and second homes, plus buy-to-let; Figure 3). Meanwhile, 35% is held in private pensions and life insurance policies (including annuities).

And a full 16% of total household wealth is still held in cash savings, despite the historically low interest rates on offer. In stark contrast, only 7% of total household wealth is held directly in shares or unit trusts exposed to shares.

Time to build up your share exposure

These statistics serve to highlight most people have not benefited anything like as much as they could have from the rise in the FTSE's value. But it is never too late.

Looking today, I would make two observations. Firstly, Europe could be a good home for new share-based fund investments given the economic recovery under way and the consequent improvement in corporate profits. And secondly, one of the best low-cost ways to achieve this is through exchange-traded funds (ETFs), which are as easy to buy as any share and can be held in any self-select stocks and shares Isa.

Don't forget, time to fill up your Isa

Remember the limit for contributions to an Isa are £15,000 for the 2014-15, which ends on 5 April, two weeks from now. So if you haven't put much or even any money into a stocks and shares ISA, now could be a good time if you have any spare cash lying around earning a minimal rate of interest in a savings account.

A good ETF to buy to get exposure to the strong recovery in Continental Europe is the iShares MSCI Europe ex-UK UCITS ETF (code: IEUX), which is priced in pounds but gives exposure to the largest companies in France (21%), Germany (21%) and Switzerland (21%) within Europe.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.