Elon Musk: China's Rare Earth Tariffs Jeopardise Tesla's AI Future

China, which controls 90% of global rare earth magnet production, halted exports of seven key elements, including terbium and dysprosium

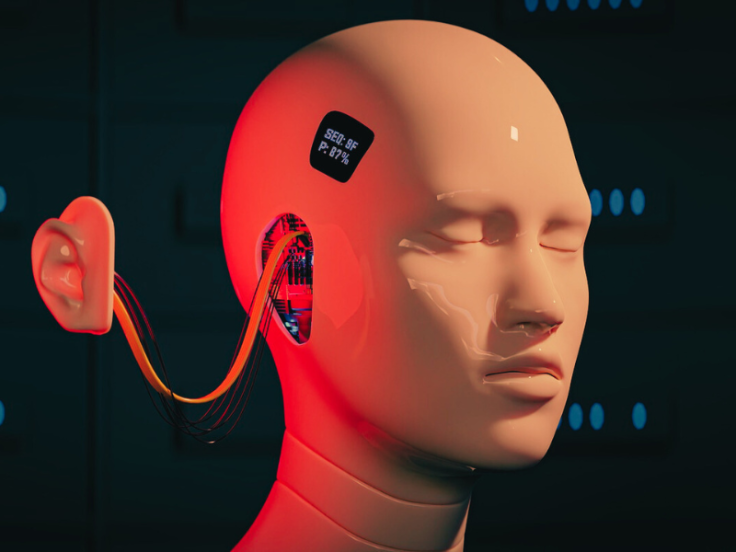

China's recent export curbs on rare earth magnets have thrown a wrench into Tesla's ambitious plans for its Optimus humanoid robots, threatening the company's AI-driven future.

Speaking on a Tesla earnings call on 22 April 2025, CEO Elon Musk revealed that these restrictions, imposed in retaliation for U.S. tariffs, are delaying production of Optimus, a cornerstone of Tesla's push into artificial intelligence and robotics.

As investors eye Tesla's next growth engine, this setback highlights the fragility of global supply chains in an escalating trade war.

Secure Alternative Supply Chains Now

Tesla's Optimus robots rely on rare earth magnets, critical for their high-performance electric motors. China, which controls 90% of global rare earth magnet production, halted exports of seven key elements, including terbium and dysprosium, on 4 April 2025.

Musk noted that Tesla is seeking export licences from Beijing, assuring authorities the magnets are for civilian use in Optimus, not military purposes. However, approvals could take six to eight weeks or longer amid U.S.-China tensions costing Tesla precious time.

With Optimus production already complex due to 10,000 unique parts, Musk admitted on the call that progress is 'totally impossible' to predict precisely.

Mitigate Tariff Impacts Urgently

The rare earth curbs are part of China's response to President Trump's 54% tariffs on Chinese goods, which Musk said also hit Tesla's energy business, particularly lithium iron phosphate battery cells sourced from China.

Tesla's stock slid 5.8% before the earnings call, reflecting a 71% drop in Q1 profit to £327 million ($433 million). Musk highlighted Tesla's localised supply chains in the U.S., Europe, and China as a buffer, but the company still depends on Chinese materials for batteries and robotics.

Posts on X echo investor concerns, with some questioning whether Tesla can meet its goal of producing 5,000 Optimus units by year-end. Musk remains optimistic, aiming for 1 million units annually by 2030.

Compete With China's Robotics Surge

China's restrictions come as its own robotics industry gains ground. Firms like Unitree Robotics and AgiBot plan to mass-produce humanoid robots in 2025, with Unitree's G1 model priced at £12,800 ($16,000) compared to Optimus's estimated £16,000 ($20,000).

A CNBC report notes China's lead in humanoid robot patents, with 5,688 filings over five years versus 1,483 from the U.S. Tesla faces stiff competition, especially as Chinese EV makers like BYD deploy robots in factories.

Musk acknowledged this challenge, warning that Chinese firms could dominate the robotics leaderboard without swift U.S. innovation. Tesla's AI ambitions, including autonomous vehicles and robotaxis, hinge on overcoming these supply and competitive pressures.

Act To Safeguard Tesla's Vision

China's rare earth tariffs expose Tesla's vulnerability in a geopolitically charged trade landscape, jeopardizing fears that they may derail Elon Musk's vision for an AI-driven future.

The Optimus project, meant to revolutionise industries from manufacturing to household services, faces delays that could erode investor confidence, already shaken by a 37% stock drop in 2025. Musk's push to secure licences and explore non-Chinese suppliers is critical, but time is tight.

As Tesla navigates this crisis, its ability to adapt will shape whether it can lead the global robotics race or cede ground to China's rising tech giants. This moment underscores the high stakes of Tesla's AI gamble in a world of fractured supply chains.

© Copyright IBTimes 2025. All rights reserved.