Anticipated increase in India's current account deficit to weigh on rupee valuation.

M Rochan

May 31, 2014

But analysts warn that internationalisation of Chinese currency could take 25 years.

Finbarr Bermingham

May 30, 2014

Weak demand in leading bullion buyer China also weighs on prices.

M Rochan

May 29, 2014

Political upheaval in India and Thailand propelling nations in different directions.

M Rochan

May 22, 2014

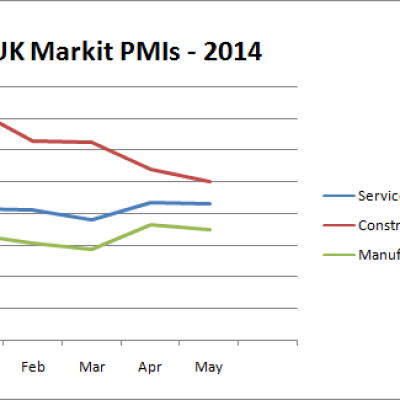

Sterling climbs to its highest rate since 2009, but manufacturers warn that it could hurt exports.

Finbarr Bermingham

May 01, 2014

Rouble depreciation led to falling income and profits in the first quarter.

Finbarr Bermingham

Apr 30, 2014

Singapore has overtaken the British capital as the top overseas clearing centre for China's RMB.

Finbarr Bermingham

Apr 29, 2014

Deutsche Bank research shows Britain has less than 1% of the world's foreign currency reserves.

Nigel Wilson

Apr 02, 2014

Deal comes after similar agreement between Germany and China.

Jerin Mathew

Apr 01, 2014

Investors show confidence in Turkey after Prime Minister Erdogan's AK Party wins local elections.

Nigel Wilson

Mar 31, 2014

Deal will make London first western yuan trading hub.

Jerin Mathew

Mar 26, 2014

Barclays advises investors to take profits before election results.

M Rochan

Mar 26, 2014

Yen lost nearly 7% against US dollar in fourth quarter of 2013, while Brazilian real fell more than 6% and Canadian dollar dropped 3%.

Jerin Mathew

Mar 18, 2014

Traditional safe-havens such as Swiss franc and Japanese yen also gain.

M Rochan

Mar 13, 2014

Brokerages expect Indian rupee to hit 59 in near term.

M Rochan

Mar 11, 2014

Foreign funds have bought $5.6bn in Indian debt and over $800m in equities this year.

M Rochan

Mar 10, 2014

Upbeat current account deficit numbers boost sentiment in Asia's third-largest economy.

M Rochan

Mar 06, 2014

Yuan tumbled on 28 February on rumours PBoC would widen currency's trading band.

M Rochan

Mar 04, 2014

Rouble fell 2.5% against the dollar to 36.44 and 1.5% against the euro to 50.21.

Jerin Mathew

Mar 03, 2014

Yuan forecast to gain 2.9% in remainder of 2014.

M Rochan

Feb 28, 2014

Yuan payments heavily concentrated in Hong Kong.

M Rochan

Feb 27, 2014

Rupee closes at 61.9350/9450 versus US dollar on 25 February.

M Rochan

Feb 25, 2014

Yuan down for six consecutive days as China's central bank looks to curb short-term speculation.

Jerin Mathew

Feb 25, 2014

China imported and produced more gold in 2013 than its consumers bought.

M Rochan

Feb 13, 2014

China's rising borrowing costs and weaker Japanese yen threaten regional growth.

M Rochan

Jan 17, 2014

Euro and yen among major currencies anticipated to fare the worst.

M Rochan

Dec 24, 2013

MetaTrader 4 and MetaTrader 5 Trading Signals is a social trading service, which is already popular among thousands of investors and active traders.

Jun 18, 2013

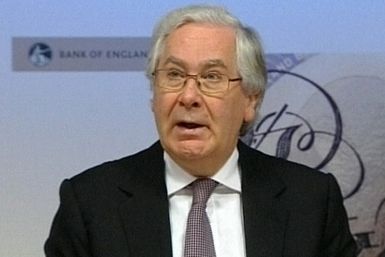

Pound sees biggest jump since July before broadcast of ITV interview with Bank of England governor that warns recent fall has gone too far.

Martin Baccardax

Mar 15, 2013

The yen extends its weak run against dollar and euro as G20 nations refrains from singling out Japan.

Prasanth Aby Thomas

Feb 18, 2013

Yen slides against dollar as BoJ governor announces his early departure.

Prasanth Aby Thomas

Feb 06, 2013