Oil remains below last week's highs but broader uptrend intact

Oil prices held below the last week's two-month high despite Tuesday's gains, but still managed to keep the uptrend since mid January.

Brent crude for spot delivery dropped to $58.36/bbl from the previous close of $58.99 before recovering to $60.25 on Tuesday. In the last week it had fallen 2.3% and Tuesday's gains only helped to reverse the losses on Monday.

At Tuesday's low Brent was down 7.4% from the 2-month high of $62.97 touched on 17 February. This correction comes after a 39% rally since the 13 January multi-year low of $45.16.

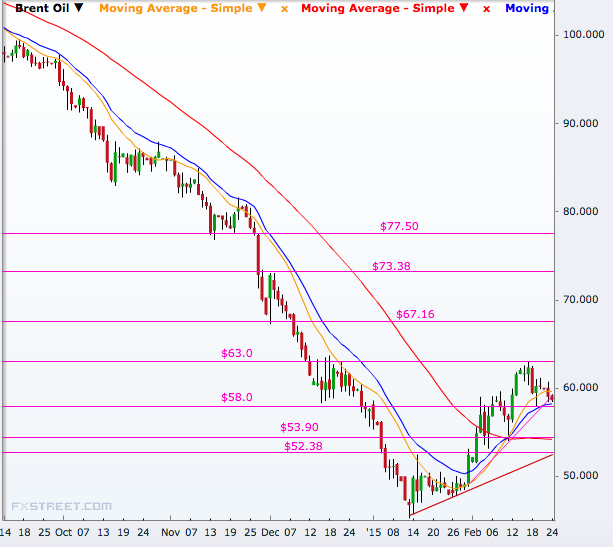

Charts suggest that the spot Brent is now testing the $58 support line, which is supported by the 14-day exponential moving average.

A break of that will also be a channel support break but the broader channel support comes near $52.38, for which the commodity has to break through $53.90 first.

A break of $53.90 will weaken the upward trend significantly and a move below the $52.38 will confirm the resumption of the downtrend since last June.

Further south, $50 and $47.50 will be the two levels to watch ahead of a retest of the January low, and on the higher side, immediate levels above the February peak are $67.16, $73.38 and $77.50.

Breaking the $77.5 barrier will weaken the downtrend since June remarkably and open up levels like $80 and $90 ahead of the big $100.

© Copyright IBTimes 2025. All rights reserved.