Want $1 Million In Retirement? Here's How Much Americans Need To Save Each Month By State

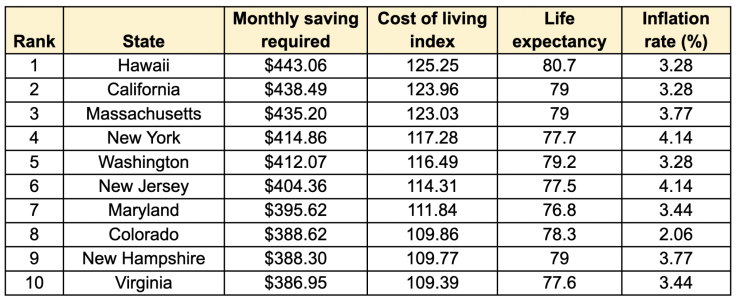

Top costliest US states are Hawaii, California, and Massachusetts

The 2025 Planning & Progress Study from Northwestern Mutual revealed that Americans think they require £939,462 ($1.26 million) to comfortably retire. To reach that goal by 65, the study estimated that one must save £246 ($330) monthly if they begin at 20. The estimated monthly savings more than double every decade you delay. For instance, someone starting retirement savings at 40 would have to set aside £1,153 ($1,547) monthly to reach that magic number.

However, these average estimates might vary significantly across US states, primarily due to living costs. A Gold IRA Custodians study showed that a Hawaii resident needs to save £330 ($443.06) monthly starting at 25 to amass £745,605 ($1 million) by 66, compared with £222 ($298.45) monthly for a West Virginia resident – a nearly £111 ($150) per month difference.

'The path to a million-dollar retirement isn't one-size-fits-all,' says Tim Schmidt, founder of Gold IRA Custodians. 'Where you live plays a huge role in how much you need to set aside each month. What might seem like an impossible goal in Hawaii could be much more achievable in the Midwest.'

'Our findings highlight the critical importance of two factors in retirement planning: location and timing. Where you live significantly impacts how much you need to save, with a nearly $150 monthly difference between the most and least expensive states. But even more vital is when you start saving,' he added.

The study assumed a 7% inflation-adjusted annual return on investments, state-wise inflation levels and cost of living index based on post-tax estimates. Hawaii has the highest cost of living index at 125.25, meaning it is over 25% more expensive than the national average, which can be attributed to its isolated location and reliance on imports. 'Almost everything costs more there, from housing to groceries, which translates directly into a higher savings requirement to maintain comfortable living standards in retirement,' Schmidt said.

California, Massachusetts Come Second to Hawaii

California residents need to save £326 ($438.49) monthly to amass a million dollars by age 66. The Golden State's cost of living is 123.96, and the inflation rate is similar to Hawaii's at 3.28%. However, California's cost of living varies within the state, with lower costs in inland areas compared with higher prices in coastal regions.

Meanwhile, Massachusetts residents have to save £324 ($435.20) monthly despite a lower cost of living index than California at 123.03. This is because of the high inflation rate of 3.77%.'The state combines high housing costs with above-average expenses for healthcare and education, creating a perfect storm for retirement savers,' Schmidt said.

These top three expensive states are followed by New York, Washington, New Jersey, Maryland, Colorado, and New Hampshire.

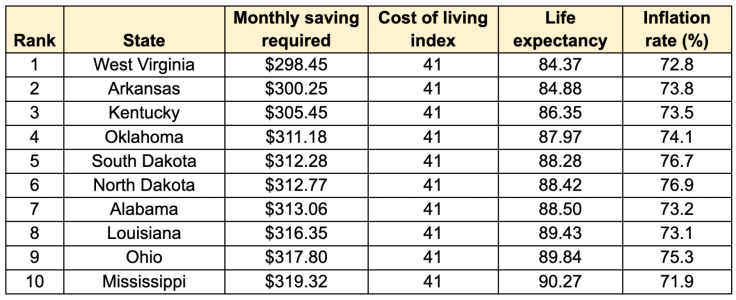

West Virginia Happens to be the Most Affordable Retirement Destination

The Gold IRA Custodians study found that West Virginia residents can save £222 ($298.45) monthly to become a millionaire by 66, given the lowest cost of living index of 84.37, implying that it is 16% cheaper than the national average. The Mountain State offers relatively lower housing costs, and daily expenses are more affordable. However, the state faces several economic roadblocks.

Arkansas follows West Virginia in terms of the lowest monthly savings required to secure retirement goals, with a cost-of-living index of 84.88. In Arkansas, residents can save £223 ($300.25) monthly in investments to grow their retirement corpus to $1 million by age 66. With a low inflation rate of 2.24% and affordable housing and transportation costs, the state offers a feasible gateway to retirement wealth.

The third US state requiring the least monthly savings is Kentucky with an 86.35 cost of living index. Despite one of the highest inflation rates at 4.82%, residents benefit from considerably lower baseline costs. People living in this state are required to save £227 ($305.45) monthly.

These top three affordable states are followed by Oklahoma, South Dakota, North Dakota, Alabama, Louisiana, Ohio, and Mississippi.

Starting Early is Key to Keeping Monthly Retirement Contributions Manageable

Starting to save at 25 in Hawaii with $443.06 monthly contributions towards retirement funds is more manageable than waiting till 40 when you have to save £870 ($1,167.25) monthly to reach the same retirement goal by 66.

'The power of compound interest is dramatic,' according to Schmidt. 'The 15-year difference between starting at 25 versus 40 more than doubles the monthly amount needed, regardless of which state you live in.'

For those who are behind on retirement savings, several strategies can help, such as maxing out contributions to 401(k) and IRA accounts and diversifying their retirement portfolio with tangible assets like gold to hedge against inflation and market upheavals. One can also relocate to a more affordable US state in retirement to prolong their life savings by years.

'Remember that even if you're starting later, consistent saving habits and smart investment choices can still put a comfortable retirement within reach. The key is to begin today, regardless of where you are in your journey,' Schmidt concluded.

© Copyright IBTimes 2025. All rights reserved.