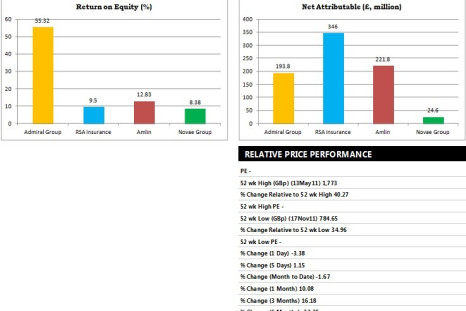

Admiral Group FY Profits May Rise by 10%, Keen on Regaining Market Confidence

Admiral Group, the private motor insurance and related products company, expects to report a rise in pre-tax profits around 10% for the full year 2011 as it is scheduled to deliver its preliminary earnings on March 7, 2012.

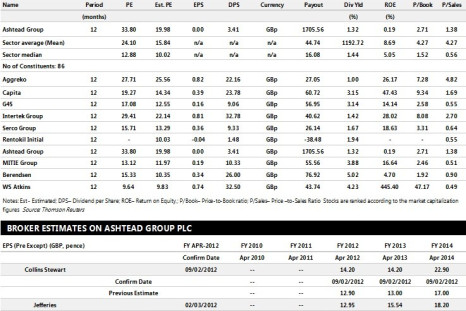

Ashtead Group Reports Record Q3 Earnings

Ashtead Group, the investment holding and management company has reported record third quarter pre-tax profits of £21m from a loss of £2m for the same period a year earlier.

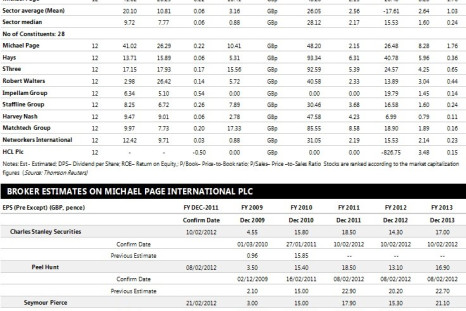

Michael Page Reports Robust FY Results

Despite the uncertain macroeconomic environment, Michael Page International, the specialist professional recruitment company, has reported solid earnings for FY 2011.

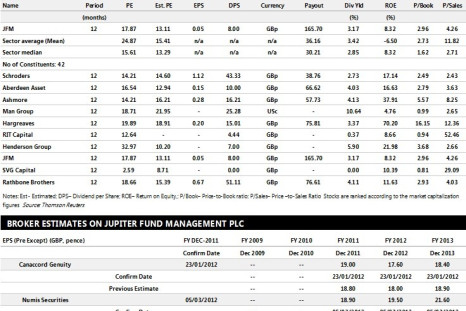

Jupiter Fund Management Expects Volatility to Impact Sentiment

Jupiter Fund Management, an investment holding company, expects the financial markets to remain volatile and flows subdued.

Michael Page Continues Diversification, Maintains Strong Financial Position

Michael Page International, the specialist recruitment consultancy, is prepared to continue its geographic expansion, as there remain many long-term development prospects in its newer territories, particularly Latin America and Asia.

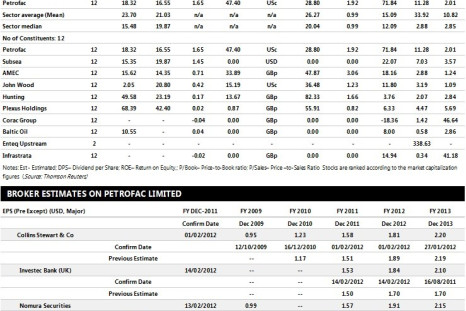

Petrofac Delivers Robust FY Performance

Petrofac, an oil & gas service provider has reported that its full year revenues rose 33 per cent to US$5.8 billion from US$4.4 billion in 2010, which shows the strong performance in all its four reporting segments.

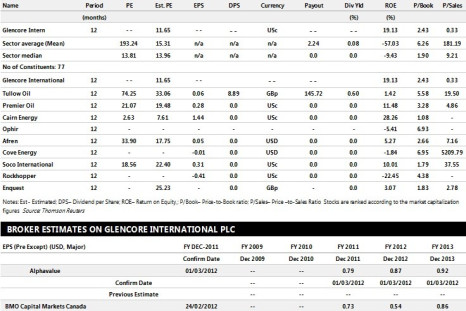

Glencore Revenues Soar by 28%

Glencore, the supplier of metals, minerals, energy and agriculture products has reported its preliminary 2011 results with revenues for the year ended 31 December 2011 at $186,152 million, a 28% increase compared to $144,978 million in 2010.

Ashtead Group in Top Brokers 'Buy' List; Positive on Beating FY Expectations

Ashtead Group, the investment holding and management company, remains confident over the outlook for end construction markets in the short term, particularly in the U.K. Ahead of Q3 results on March 6, the group has secured 'Buy' ratings from Jefferies, Peel Hunt and Numis Securities.

Glencore Bets on Greater Urbanisation in China and India

Glencore International, the supplier of metals, minerals, energy and agriculture products, remains affirmative about the long term global economic prospects and is scheduled to release its preliminary results on March 5, 2012.

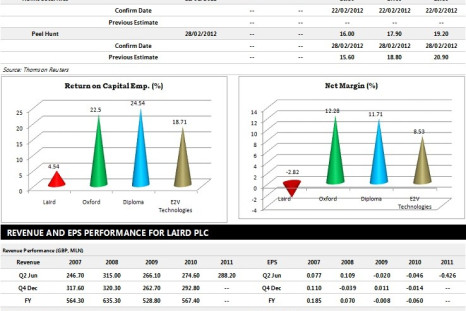

Laird FY Earnings Beat Expectations, Driven by Acquisitions

Laird, the global technology company, has reported its results for the financial year ending 31 December 2011 with an increase in revenue from continuing businesses by 19% at £491.3 million compared to 2010. Organic revenue growth rose 12%.

Petrofac Upbeat on Growth, Secures Buy Rating

Petrofac Limited, the provider of facilities solutions to the oil and gas production and processing industry, with continued growth, high levels of backlog, exceptional revenue visibility is scheduled to report its preliminary results on March 5, 2012.

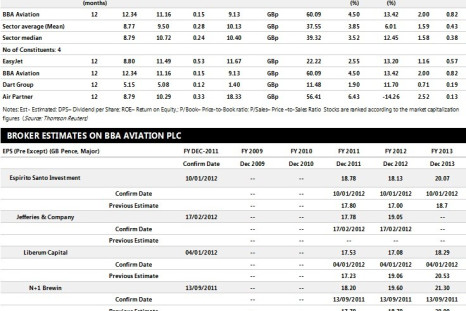

BBA Aviation FY Earnings Preview

BBA Aviation, the provider of global aviation support and aftermarket services expects to deliver a positive underlying progress achieving a full year result in line with the board's expectations. The group is scheduled to report its final results for the year ending on 31 December, 2011 on March 2, 2012.

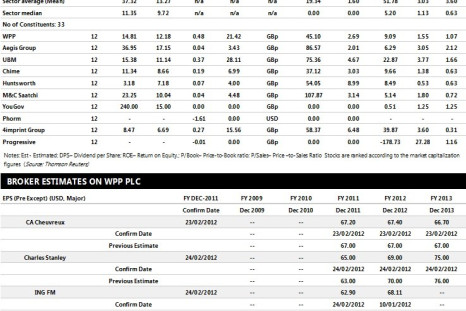

WPP Reports £1Bln Pre-Tax Profits For The First Time

WPP, the largest communications services provider, has reported a rise in its full year revenues by 7.4% to £10.022 billion and pre-tax profit of £1.00 billion for the first time

Laird On Track to Deliver FY Earnings Not less Than 16% Per Share

Laird, the supplier of products and technology solutions is confident to deliver underlying earnings of not less than 16 pence per share for the year as a whole. The group is expected to release its preliminary results on March 2, 2012 with its increase customer base and expanding technology portfolio.

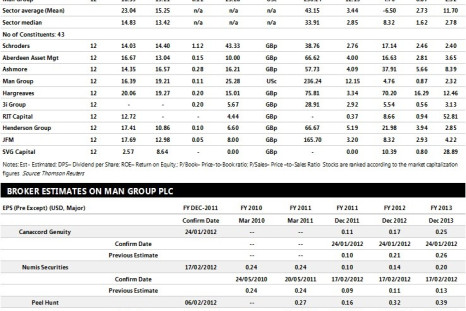

Man Group Earnings In line With Estimates

Man Group, the alternative investment management company, has reported its final results for the nine months to December 31, 2011 which are in line with expectations.

Tips on FTSE Stocks

Britain’s FTSE 100 index ended lower 56.40 points or 1 per cent at 5,871.51 on Wednesday, though investors digested the latest second round of a European Central Bank long term liquidity operation.

Man Group Secures 'Buy' Rating, Expects Positive Performance For FY 2011

Man Group, the alternative investment management company is confident to deliver the positive performance as markets are normalised and trading opportunities re-emerged.

Tweets May Not Reveal Accurate Movements of Dow or FTSE

Using the social media to predict the stock market sentiments is a bizarre task but it is not possible to ascertain the moods or emotions of investors by mining the huge chunk of data sets, especially from Twitter.

WPP Keen On Digital Revenues, Expects Improved Margins

Despite challenging economic environment, WPP, the communications services provider continues to focus on its long-term plans and strategic goals of improving operating profits by 10-15 percent per annum.

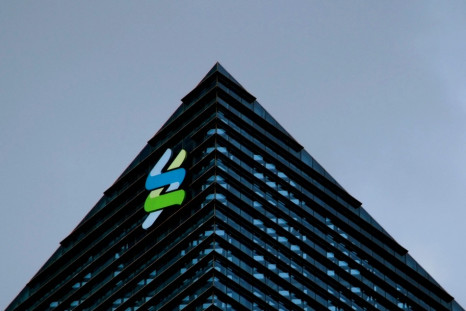

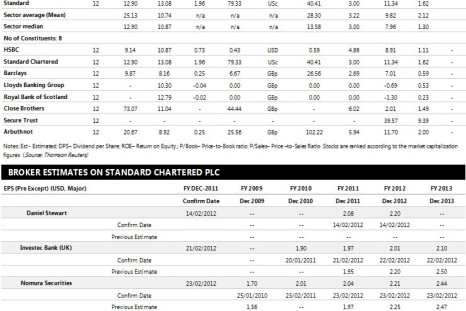

Standard Chartered Reports Stronger FY Profits

Standard Chartered, the retail and commercial banking giant has reported a 11percent rise in its annual profit before tax at $6,775 million for the year ended on 31 December, 2011.

Personal Privacy is Dead And Getting Deadlier With Nanotechnolgy

Personal privacy on high risk with the advent of nanotechnology.

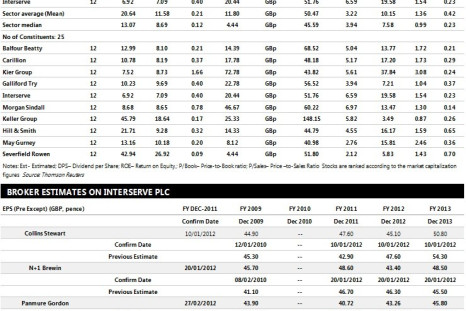

Interserve FY Earnings Preview: Chance of doubling EPS over five years

Interserve, the support services and construction company, is conscious of the continuing risks to global economic recovery and believes that it has the capability to double earnings per share over five years. The group is scheduled to release its preliminary results for the year ended December 31, 2011 on February 29, 2012.

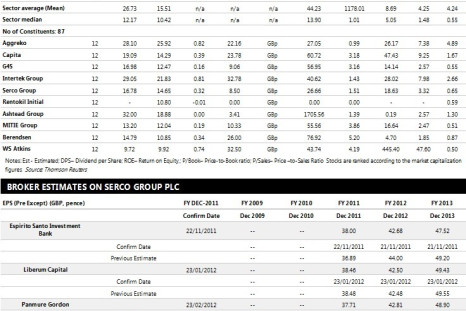

Serco posts strong FY results, Confident Over Future Growth

Serco, the services group has delivered solid results for the period ended on December 31, 2011. It recorded robust growth in revenues including good organic growth, increased the operating margins and maintained a strong cash generation profile and financing position.

Standard Chartered on Track to Deliver Robust FY Results, Secures Buy Rating

Standard Chartered, the retail and commercial banking giant, is on track to deliver another strong performance for the FY 2011. Ahead of preliminary earnings on February 29, 2012 it secured buy rating from all top brokerage houses such as Nomura Securities, Investec Bank and Seymour Pierce.

Nasa Brings Driverless Cars One Step Closer

Space-age cars driven by computer through vacuum air corridors are reality in computer tests.

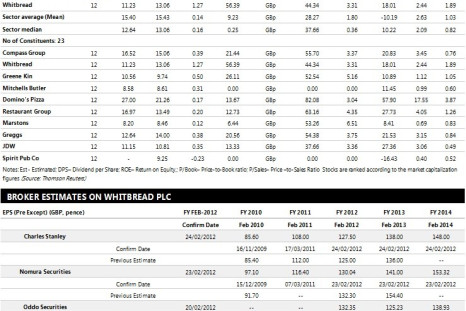

Whitbread Mulls Over Rapid Brand Expansion, Confident to Outperform

Whitbread, which owns Premier Inn, Costa, Beefeater and Brewers Fayre, is confident that it will continue to outperform in the challenging consumer economy based on the strength of its brands and its customer propositions.

HSBC Delivers Record Performance

HSBC Holdings, the global banking and financial services organisation, has reported a robust performance for the year ending December 31, 2011 with profit before taxes of $21.9billion.

Bovis Homes Reports Solid Earnings

The builder of traditional homes reported that its annual pre-tax profits rose 74% for the financial year ended 31 December 2011, as it sold more homes at a wider margins and focuses on increasing profits combined with further improvements in the use of capital. The Group also expects to deliver a strongly increasing return on capital employed in 2012 and beyond.

Serco in Top UK Brokers' 'Buy' List; FY Earnings Expectations In Line

Serco, a FTSE 100 international service company, has been added in the 'Buy' list by all the UK top brokers as it is expected to deliver the full year results in line with expectations on Tuesday, February 28, 2012.

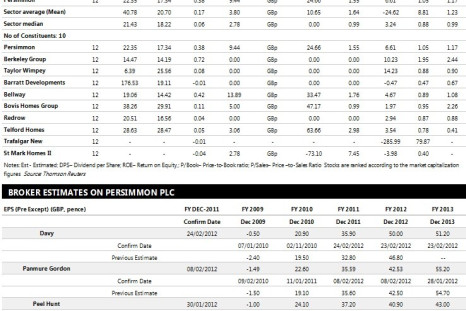

Persimmon gets ‘Overweight’ rating from JP Morgan ahead of FY Earnings

Ahead of full-year earnings, JP Morgan has assigned "Overweight" rating to the operator of Persimmon Homes, Charles Church, Westbury Partnerships and Space4 as the Group expects to perform in a challenging environment due to the overall economic situation, while the UK housing market remains stable.